|

|

|

|

|

|

| Topics >> by >> the_single_strategy_to_use_f |

| the_single_strategy_to_use_f Photos Topic maintained by (see all topics) |

||

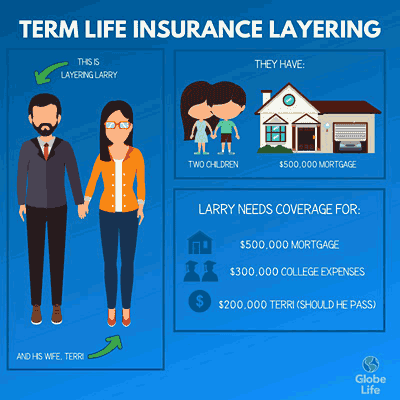

Not known Details About Northwestern Mutual - You Dream It, We'll Help You Live Itmarried or not, if the death of one grownup would mean that the other might no longer manage loan payments, maintenance, and taxes on the home, life insurance coverage might be an excellent idea. One example would be an engaged couple who secure a joint home loan to buy their very first home. This aid might also consist of direct financial backing. Life insurance coverage can assist repay the adult child's costs when the moms and dad dies. young people without dependents seldom need life insurance coverage, however if a parent will be on the hook for a child's debt after their death, the kid may wish to carry enough life insurance coverage to pay off that financial obligation.  A 20-something grownup may buy a policy even without having dependents if there is an expectation to have them in the future. stay at home partner ought to have life insurance coverage as they have considerable financial value based on the work they carry out in the home. According to, the economic worth of a stay at house parent would have been equivalent to a yearly wage of $162,581 in 2018.  5 Simple Techniques For Life Insurance - NAIC'a small life insurance policy can offer funds to honor an enjoyed one's passing. if the death of an essential employee, such as a CEO, would produce a serious financial difficulty for a company, that firm might have an insurable interest that will permit it to buy a life insurance coverage policy on that employee. This method is called pension maximization. such as cancer, diabetes, or cigarette smoking. Note, nevertheless, that some insurance companies might reject coverage for such people, or else charge really high rates. Considerations Prior To Purchasing Life Insurance due to the fact that life insurance policies are a major expenditure and commitment, it's critical to do appropriate due diligence to make certain the company you choose has a strong performance history and monetary strength, offered that your successors may not receive any death advantage for numerous years into the future. Life insurance coverage can be a prudent financial tool to hedge your bets and supply security for your liked ones in case of death ought to you pass away while the policy is in force. Nevertheless, there are This Is Noteworthy in which it makes less sensesuch as purchasing excessive or guaranteeing those whose income does not need to be changed. |

||

|

||