|

|

|

|

|

|

| Topics >> by >> academy_for_info_tech_chan_c |

| academy_for_info_tech_chan_c Photos Topic maintained by (see all topics) |

||

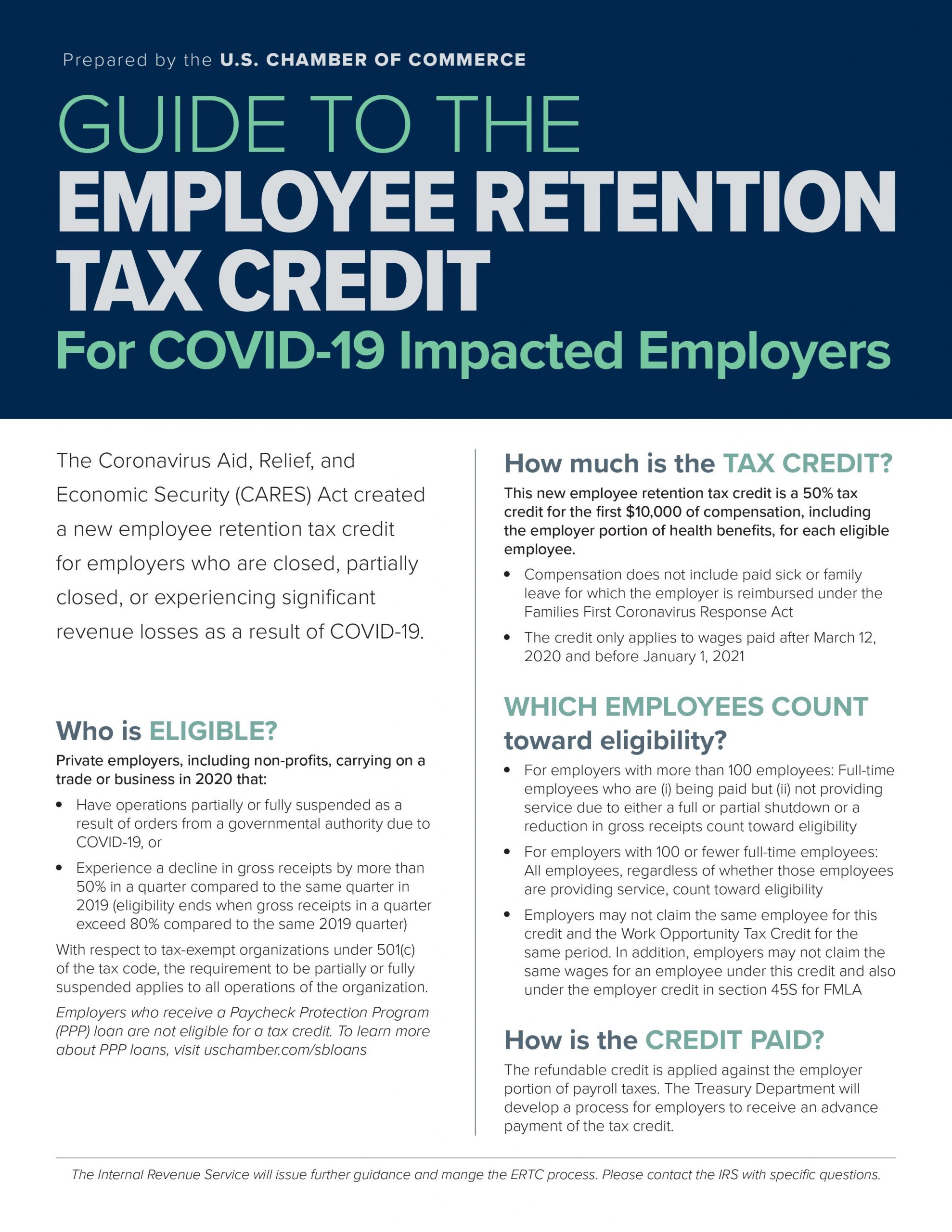

The smart Trick of ERC Employee Retention Credit Filing Services in 5 Days or That Nobody is DiscussingCARES Act 2020 Normally, if gross receipts in a calendar quarter are listed below 50% of gross receipts when compared to the very same calendar quarter in 2019, a company would certify. They are no longer eligible if in the calendar quarter right away following their quarter gross receipts surpass 80% compared to the same calendar quarter in 2019. If you are a new service, the internal revenue service allows the use of gross invoices for the quarter in which you began business as a referral for any quarter which they do not have 2019 figures since you were not yet in organization. American Rescue Strategy Act 2021 In addition to eligibility requirements under the Consolidated Appropriations Act, 2021, business also have the option of identifying eligibility based upon gross receipts in the instantly preceding calendar quarter (compared with the corresponding quarter in 2019). Recovery Startup Service American Rescue Plan Act 2021 3rd and 4th quarter 2021 just a 3rd classification has been included. Another Point of View that certify may be entitled to approximately $50,000 per quarter. To qualify as a Healing Startup Service, one need to: Have started continuing trade or service after Feb.  It must also be noted that identifying if this classification uses is assessed for each quarter. So, if among the other 2 categories gross receipt decline or full/partial suspension applies to 3rd quarter however not fourth, they would not be a recovery startup in 3rd quarter, yet they may still qualify as a recovery startup in 4th quarter. Claim The Employee Retention Credit For 2021 - Tri-Merit - The FactsKind 941-X will be utilized to retroactively declare the relevant quarter(s) in which the certified incomes were paid. Facilities Investment and Jobs Act 2021 This law removes a condition of eligibility. Healing start-ups are no longer subject to business closure or gross invoices reduction to certify. Basically all RSBs are eligible in fourth quarter.   What incomes qualify when computing the retention credit? Wages/compensation, in basic, that undergo FICA taxes, in addition to competent health costs certify when determining the worker retention credit. These need to have been paid after March 12, 2020 and get approved for the credit if paid through Sept. 30, 2021 (Recovery Startup Organizations have up until Dec. |

||

|

||