|

|

|

|

|

|

| Topics >> by >> personal_finance_internati |

| personal_finance_internati Photos Topic maintained by (see all topics) |

||

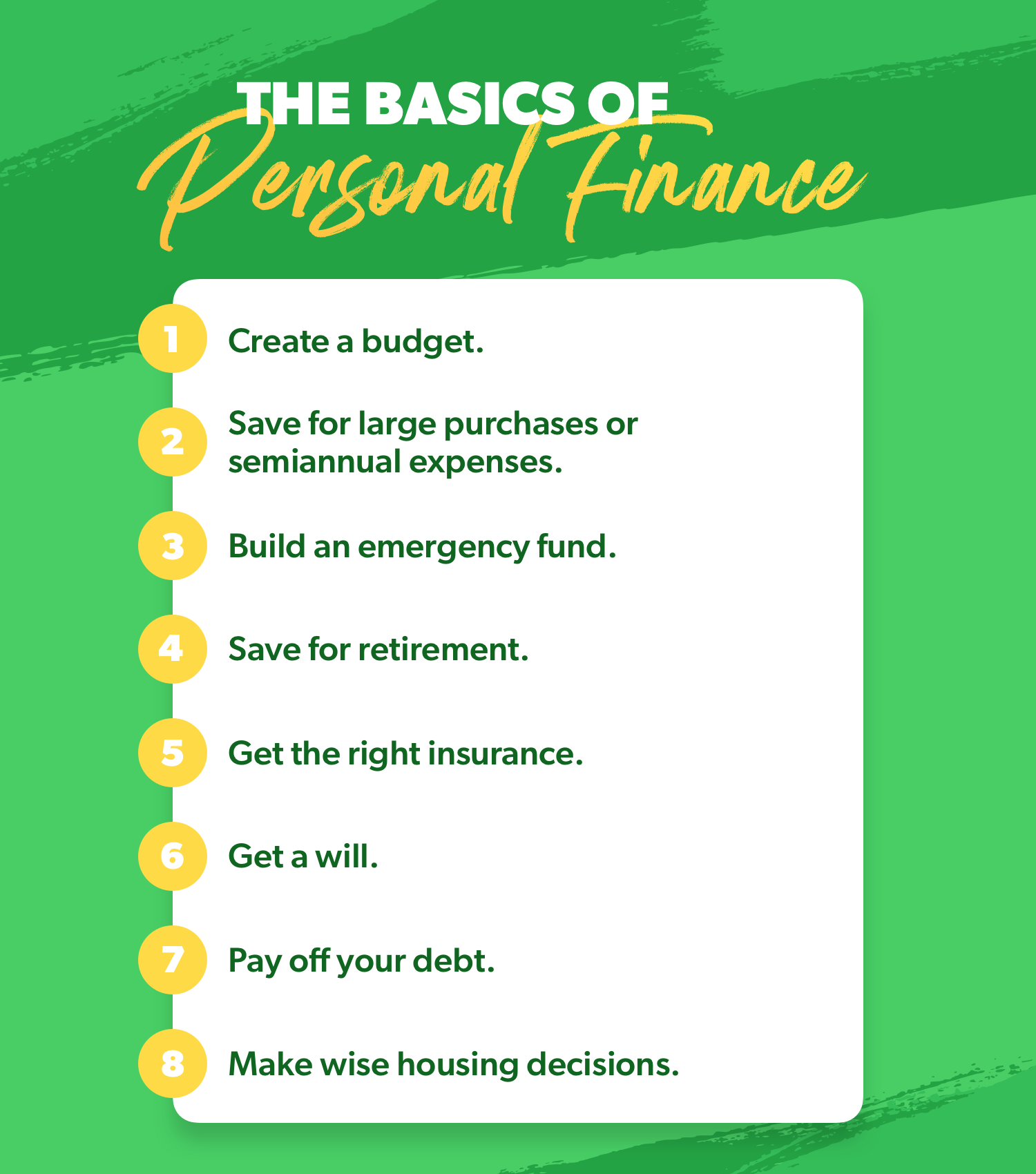

The Single Strategy To Use For Personal Finance Manager - Budget Tool at State Bank ofFederal law enables you to get totally free credit reports once a year from the 3 significant credit bureaus: Equifax, Experian, and Trans, Union. Reports can be obtained directly from each agency, or you can register at, a federally licensed site sponsored by the Big 3. You can also get a complimentary credit report from sites such as Credit Karma, Credit Sesame, or Wallet, Center. All of the above deal your Vantage, Rating. Due to the COVID-19 pandemic, the three significant credit bureaus are offering complimentary credit reports once a week through a minimum of April 2022. 6. Consider your household To secure the possessions in your estate and ensure that your wishes are followed when you die, be sure you make a will anddepending on your needspossibly established several trusts.  And periodically review your policy to ensure it satisfies your family's requirements through life's major milestones. Other crucial files consist of a living will and health care power of attorney. While not all of these documents directly affect you, all of them can conserve your near relative considerable time and cost when you fall ill or end up being otherwise disabled. The Ultimate Guide To Online Personal Finance Course & Curriculum - K12 Store7. Settle student loans There are myriad loan repayment strategies and payment reduction strategies readily available to graduates. If you're stuck to a high rates of interest, then paying off the principal quicker can make sense. On Try This , minimizing payments (to interest only, for circumstances) can free up earnings to invest elsewhere or take into retirement cost savings while you're young, when your savings will get the maximum gain from compound interest (see pointer 8).  Versatile federal payment programs worth having a look at consist of: Finished payment, Progressively increases the monthly payment over ten years Extended repayment, Stretches out the loan over a duration that can be as long as 25 years Income-driven payment, Limitations payments to 10% to 20% of your income (based upon your earnings and family size) 8. |

||

|

||