|

|

|

|

|

|

| Topics >> by >> see_this_report_on_medicare |

| see_this_report_on_medicare Photos Topic maintained by (see all topics) |

||

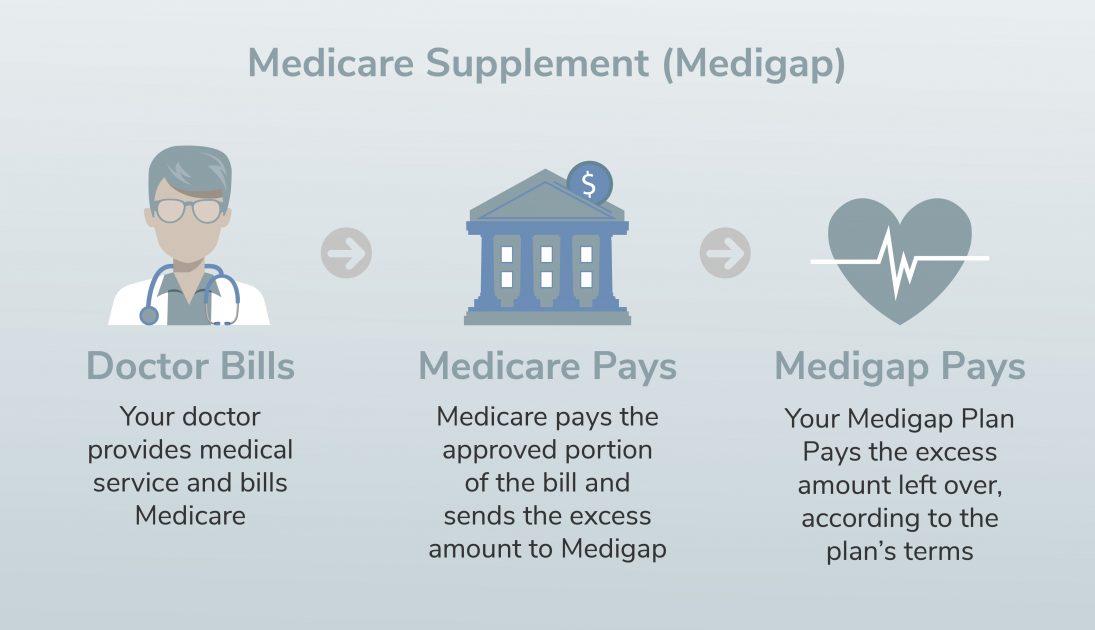

3 Simple Techniques For Medicare Supplement Insurance Plans - Blue Cross and BlueAs an outcome of HR2 (MACRA), which was signed into law in 2015, those strategies are no longer offered to individuals who weren't already eligible for Medicare prior to 2020. This Site who were currently registered in Strategy C and Plan F can keep their coverage. And people who were Medicare-eligible previous to the start of 2020 can still obtain Strategy C or Strategy F. The concept was to remove first-dollar coverage under Medigap strategies in an effort to avoid over-utilization of healthcare (ie, guarantee that enrollees have some "skin in the game" instead of having all of their costs covered by Medicare and supplemental protection). So individuals who become qualified for Medicare in 2020 or later on can still buy Medigap strategies that cover nearly all of their out-of-pocket costs for Medicare-covered services, however they will need to pay the Part B deductible on their own if and when they need outpatient care.  Excitement About Medicare Supplement Insurance Plans(The Part B deductible is a per-year charge, as Medicare's benefit periods only use to inpatient care under Medicare Part A.) Anybody who becomes qualified for Medicare in 2020 or later is not able to purchase a Medicare Supplement plan that covers that charge. But there are plans offered that cover the rest of the out-of-pocket expenses for covered services under Original Medicare, leaving the recipient with only the Part B deductible to cover themselves. And obviously, the prices likewise differ from one strategy level to another, as each plan level offers various benefits (ie, a Strategy K will cost less than a strategy G, since out-of-pocket expenses are much higher under Strategy K). You can see Medigap strategy expenses in your area by entering your zip code, age, gender, and tobacco status into Medicare's plan finder tool.  6 Easy Facts About Medicare Supplement/Medigap DescribedHowever in New york city, where Medigap premiums don't vary based on age, Plan A prices begins at around $150. However, the exact same premiums would use to an 85-year-old in New York City, whereas an 85-year-old in many states would pay more than a 65-year-old. Strategy G, which is the most extensive Medigap policy offered to newly-eligible Medicare recipients, tends to have premiums (for a 65-year-old) that begin around $110 to $130 per month, and range well above $300 each month, depending on the insurance coverage business that's providing the strategy. |

||

|

||