|

|

|

|

|

|

| Topics >> by >> qualified_life_events_smu |

| qualified_life_events_smu Photos Topic maintained by (see all topics) |

||

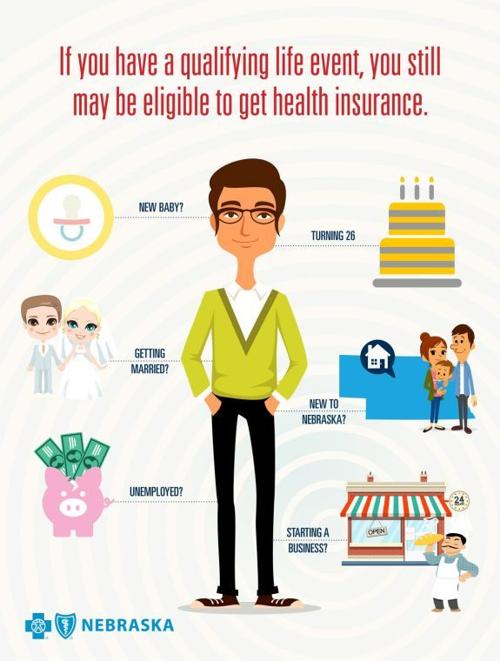

Qualifying Life Events for Health Insurance Change - Aetna Fundamentals ExplainedIt appears like Java, Script is handicapped in your web browser. Sadly, you won't have the ability to use without Java, Script made it possible for. Read This can show you how to make it possible for Java, Script . Due to internal revenue service guidelines, you can not make changes to your medical insurance advantages beyond your employer's annual open registration duration unless you experience a qualifying life occasion (QLE). A QLE is a change in your circumstance like getting married, having a child, or losing health coverage that can make you qualified for a special enrollment duration. Life Events - MIT Human Resources Can Be Fun For Anyone You will be asked to include: Supporting documents (see "Needed Files" below), and The date the modification happened. Beyond the special registration duration, your only chance to make a change is during your company's annual open registration (or if you experience another certifying life event). Can I offer a QLE for a future change? No, this concern turns up a lotspecifically for those expecting a baby. It's beneficial to note that, particularly and for the birth of a child, protection is always retroactively available since the birth date. See the "QLE Effective Date" area at the bottom of this short article for more information. 4 Standard Types of QLEs, The most common examples include: Loss of health protection, Losing existing health coverage, including job-based, private, and student plans, Losing eligibility for Medicare, Medicaid, or CHIPTurning 26 and losing protection through a moms and dad's plan, Changes in family, Getting married or divorced, Having a baby or adopting a child, Death in the household, For employer-sponsored health insurance, modifications in home qualify if the relocation indicates the worker no longer has coverage on their existing strategy (example: Staff member is on a California HMO, but relocates to Texas). |

||

|

||