|

|

|

|

|

|

| Topics >> by >> some_known_factual_statement |

| some_known_factual_statement Photos Topic maintained by (see all topics) |

||

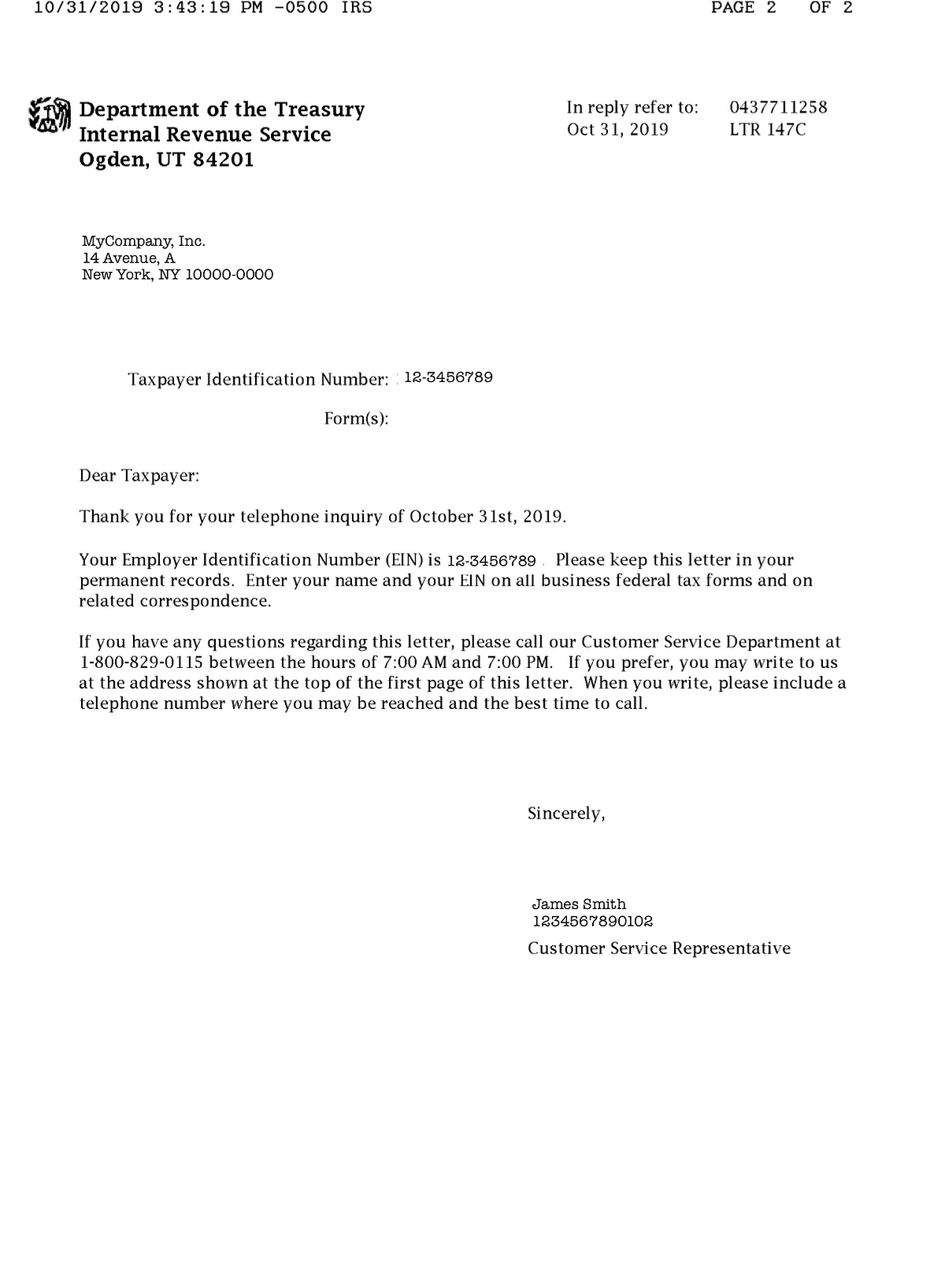

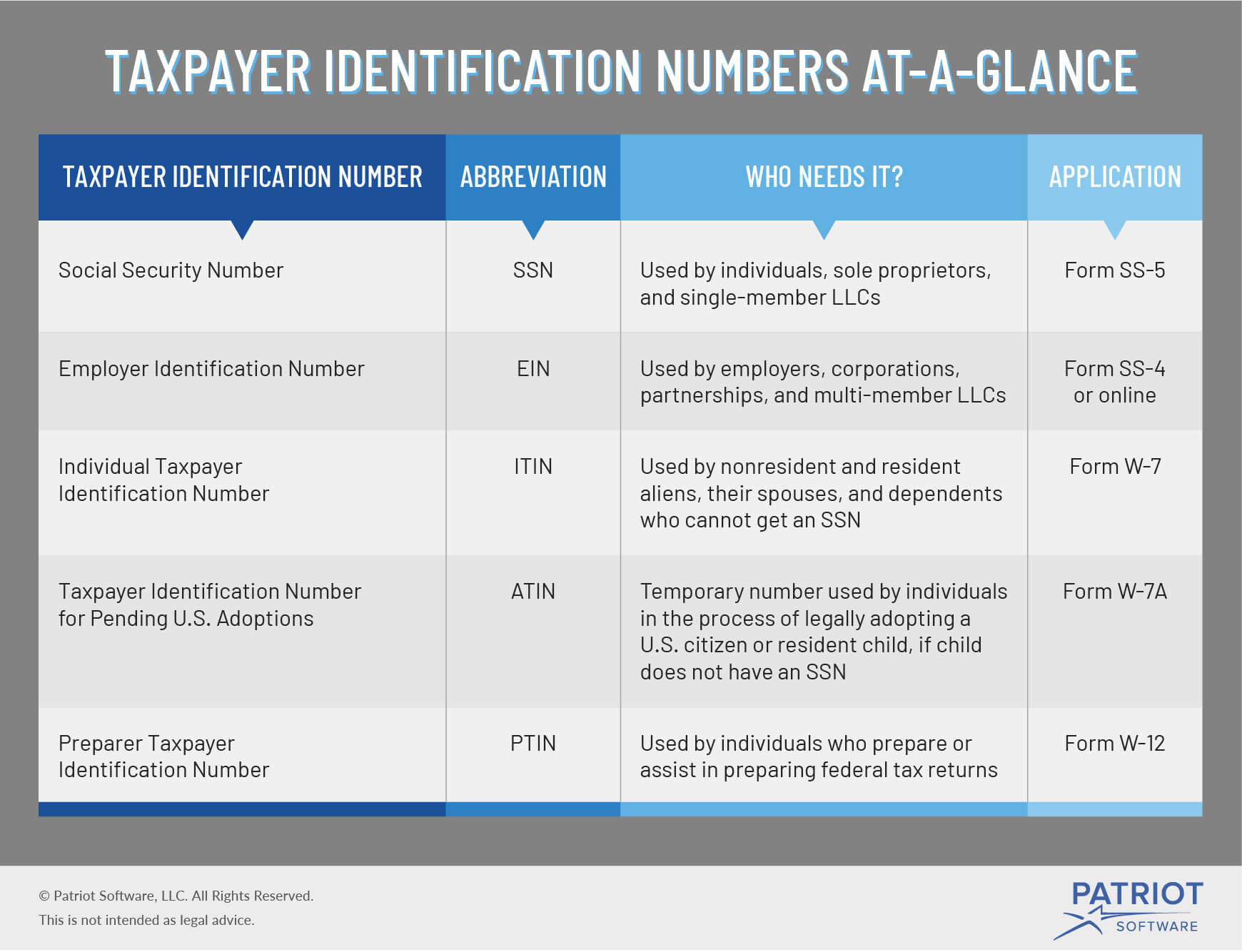

Facts About Obtaining a UCLA Employer Identification Number (EIN) Uncovered This specific or entity, which the IRS will call the 'responsible celebration', controls, handles, or directs the applicant entity and the personality of its funds and possessions. Unless the candidate is a federal government entity, the accountable party must be an individual (i. e., a natural individual), not an entity.". Page Last Examined or Upgraded: 02-Jul-2021.  INFORM ME MORE Advantages of getting an EIN Separate your Finances An EIN allows the IRS, banks, credit card companies and other entities to track your service and individual financial resources individually. Open a Savings Account Banks and credit unions require an EIN to open a checking account and it's also valuable when trying to get funding for your company. Facts About All About Your Employer ID Number (EIN) - The Balance UncoveredWhy do I require an Employer ID Number (EIN)? An Employer Identification Number (EIN), also called a Tax ID Number, is a 9-digit code designated by the IRS to recognize your company. You can consider it as the social security number for your company. An EIN is needed for a collaboration, corporation, or LLC to open a business bank account, gain funding, employ staff members, and more.  It is extremely encouraged that you acquire a federal EIN number and open a separate service savings account so you can keep your service and personal deals different. Other crucial reasons to get an EIN An EIN establishes your business as a separate entity, which protects limited liability should your company ever be taken legal action against. What Is an Employer Recognition Number (EIN)? The term employer identification number (EIN) describes a distinct identifier that is designated to a service entity so that it can quickly be identified by the Irs (IRS). business credit news are commonly utilized by companies for the function of reporting taxes.  The Ultimate Guide To Getting an EIN is Easier Than You Think- Here's HowOrganizations can get EINs directly through the internal revenue service, which usually releases them instantly. Secret Takeaways An employer recognition number is an unique nine-digit number that is appointed to an organization entity. EINs allow the internal revenue service to quickly determine companies for tax reporting purposes. All organizations that satisfy specific requirements need to have an EIN before they can begin running. |

||

|

||