|

|

|

|

|

|

| Topics >> by >> some_known_details_about_how |

| some_known_details_about_how Photos Topic maintained by (see all topics) |

||

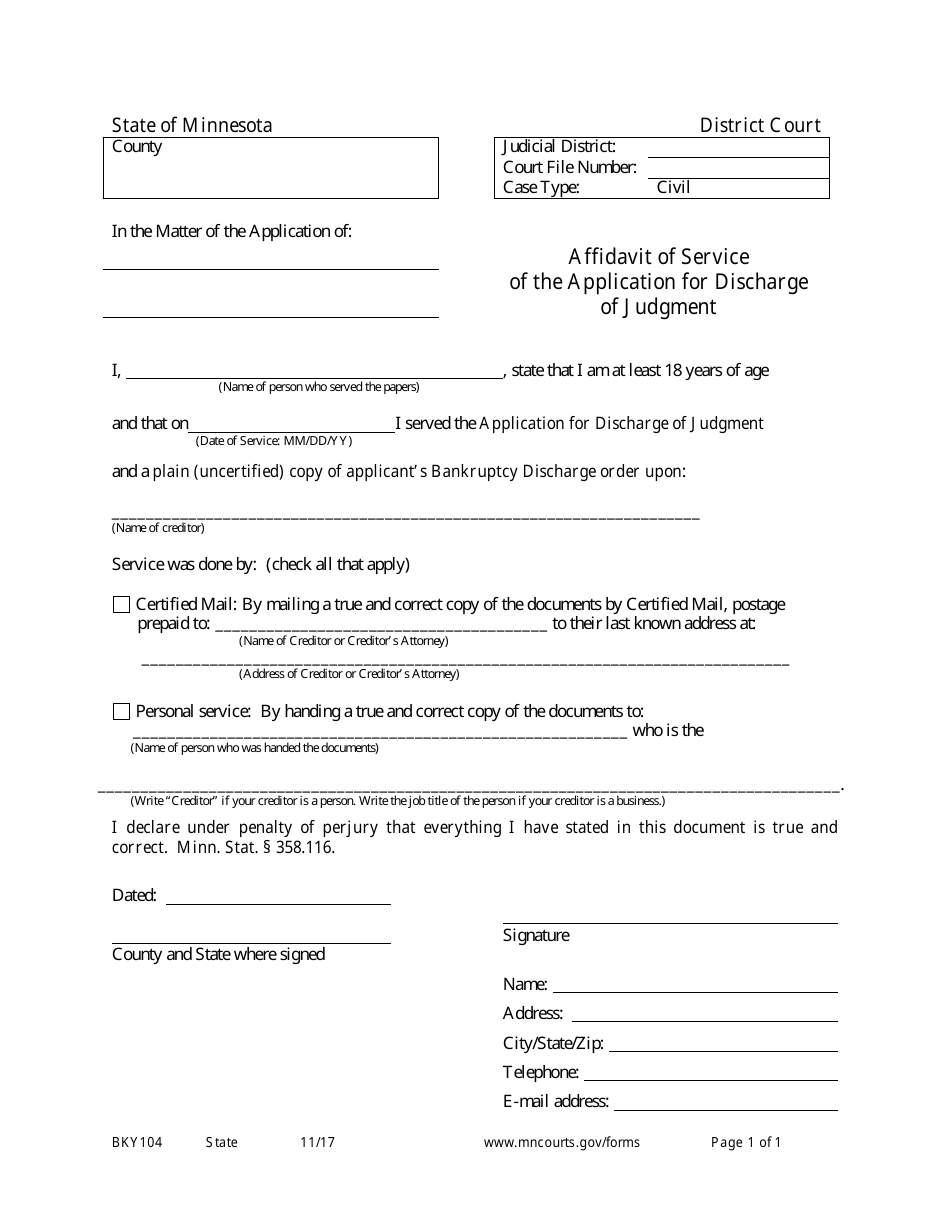

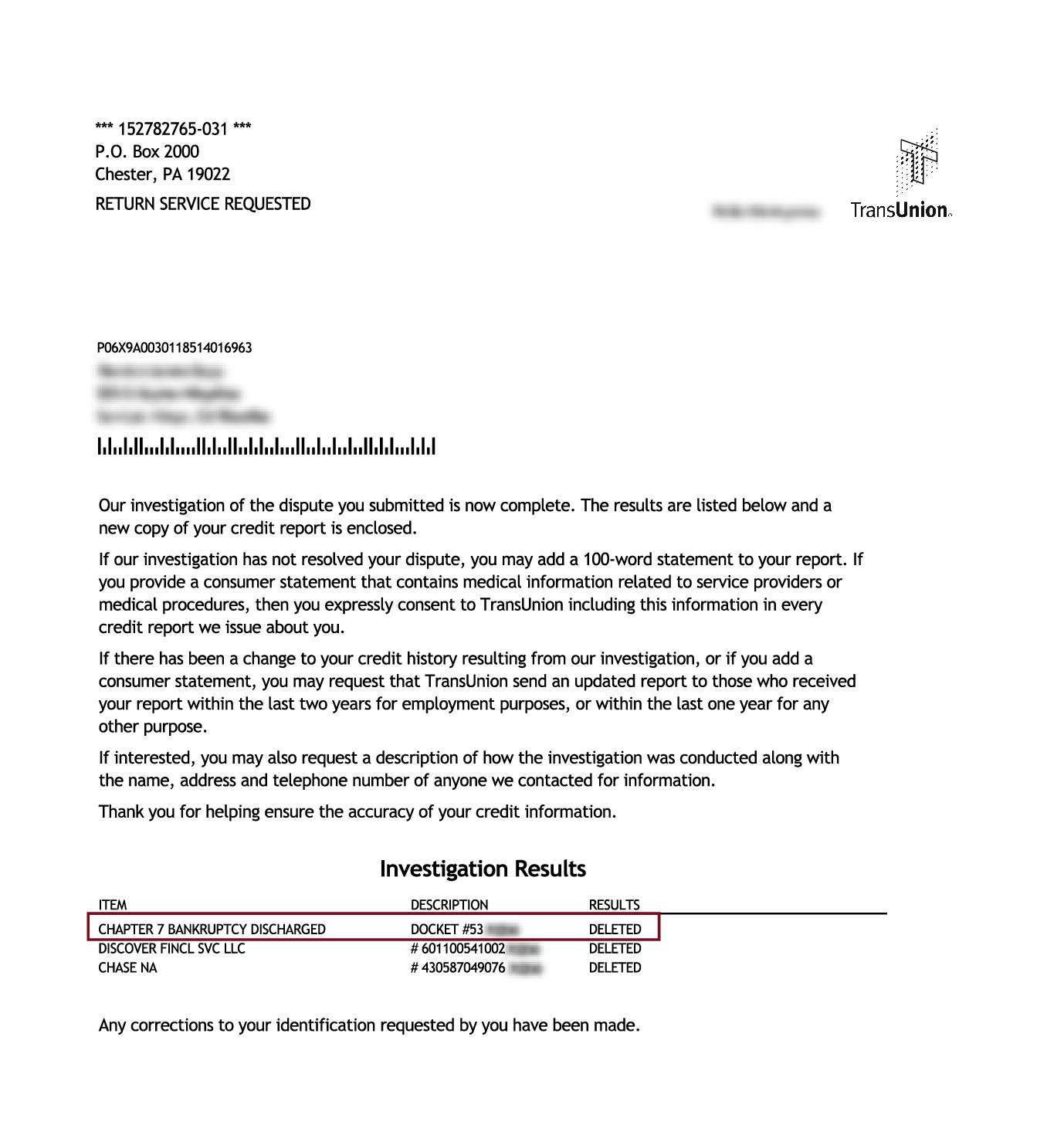

The Definitive Guide to DOR: Bankruptcy Forms - IN.govHaving a copy of your bankruptcy records can be extremely useful in the event you get sued on a financial obligation that must be discharged or require to dispute a discharged debt with the credit reporting firms. Tabulation A personal bankruptcy discharge order releases the debtor from personal liability for various types of debt.  A financial institution can not gather upon a debt when the personal bankruptcy court releases it in either a chapter 7 personal bankruptcy or a chapter 13 personal bankruptcy. For this reason it is important to keep a copy of your bankruptcy discharge. If I Found This Interesting lost or misplaced your copy you must attempt to get a copy of your bankruptcy records. A Biased View of Satisfying Due to Discharge in Bankruptcy - Sauk CountyFrequently when there are errors on a credit report. Credit reporting company requirements frequently need a copy of the discharge to make necessary modifications. When the insolvency court concerns a discharge order for unsecured debt, a lot of if not all credit card financial obligation, medical debt, and other unsecured types of debt can no longer be collected upon by your lenders.  A debtor will desire to preserve proof of their personal bankruptcy filing if a credit seeks to collect on an unsecured financial obligation after the personal bankruptcy is completed. Your insolvency records will consist of all of the financial institutions you owed money to. It will also include a copy of your discharge order. Secured financial institutions are treated differently after a discharge order is issued.  The Only Guide to How to Get Copies of My Bankruptcy PaperworkTypical forms of secured debt include an auto loan and debts held by mortgage companies. The valid lien on residential or commercial properties that an insolvency filing has actually not cleared in this matter will remain efficient after personal bankruptcy lawsuits. A protected creditor should implement the lien to recover the belongings of the residential or commercial property subject to the lien.  A top priority debt is a financial obligation that normally makes it through bankruptcy. Common forms of top priority debt consist of kid support, particular forms of taxes, and other debts the United States Insolvency Code attends to special treatment. Similar to the other types of debt, keeping a copy of your personal bankruptcy records can be handy if you require evidence of your insolvency court records. |

||

|

||