|

|

|

|

|

|

| Topics >> by >> top_guidelines_of_health_ins |

| top_guidelines_of_health_ins Photos Topic maintained by (see all topics) |

||

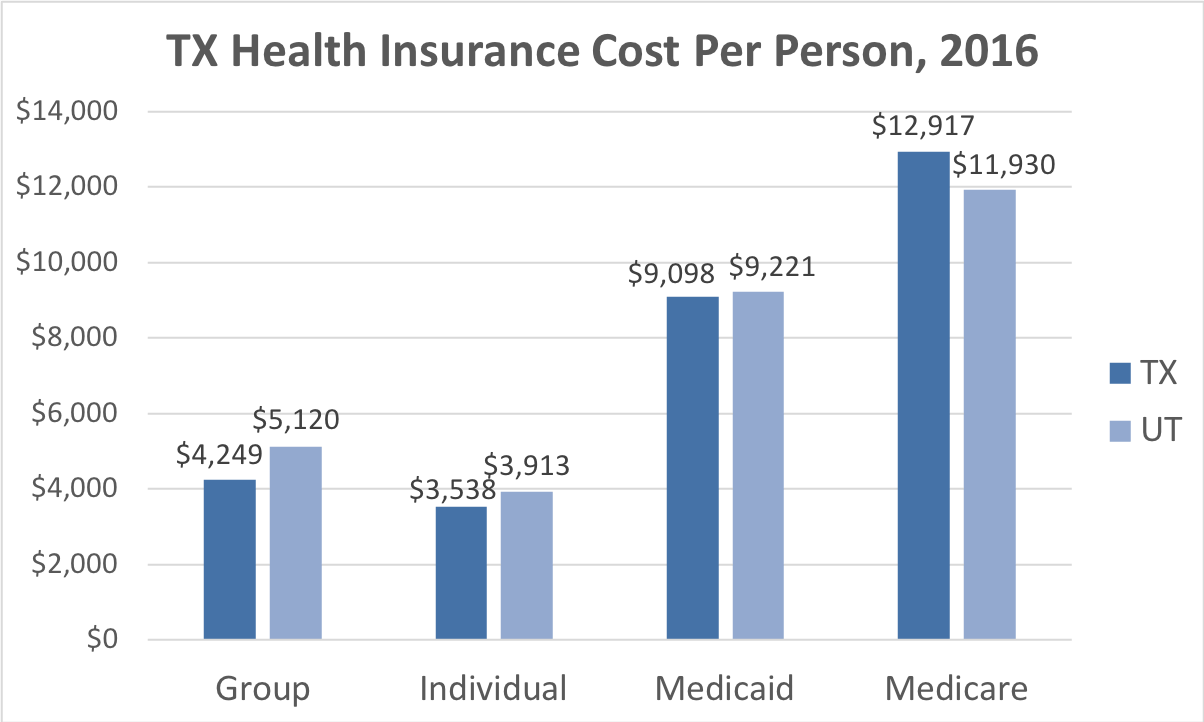

Unknown Facts About Texas workers pay more — much more — for employer healthYou can find out a business's monetary rating from an independent ranking company, and its complaint record by calling our Aid Line or checking our website. If A Good Read purchase from a business that does not have a license, your employees' claims could go unsettled. You can find out whether a business has a license by calling our Customer service or by looking for the company on our website. Insurer can't deny or limit protection to workers with pre-existing conditions. Insurance coverage companies consider the following factors when setting your premiums: Plans utilize a formula set by federal regulation when factoring age into premium amounts. The premium for a worker who is 64 will be three times higher than the premium for a worker who is 21.   The higher rate is spread amongst all the group's members. Health care expenses vary by area because of distinctions in the cost of living and the variety of service providers in the location. Strategies can vary on how your workers get care. For example, some strategies might require your employees to use physicians and providers in the health plan's network. The Definitive Guide for Employer Group Solutions - Texas Bar Private InsuranceIn basic, plans that have less healthcare suppliers to pick from will have lower premiums. Under state and federal law, most workers have the choice to keep their protection for a while after they leave their task. You need to tell workers about how they can keep their protection. Previous workers who keep their coverage pay the full cost of the strategy. The federal COBRA law uses to employers with 20 or more staff members. The state extension law applies to companies of any size. If you're a small company owner in Texas, you may certify for a tax credit that might cover some of the expenses you spend for employees' premiums. If you qualify, e, Health can help you acquire your tax credit and find a small company health insurance coverage strategy that works best for you and your employees.  |

||

|

||