|

|

|

|

|

|

| Topics >> by >> 9_simple_techniques_for_defi |

| 9_simple_techniques_for_defi Photos Topic maintained by (see all topics) |

||

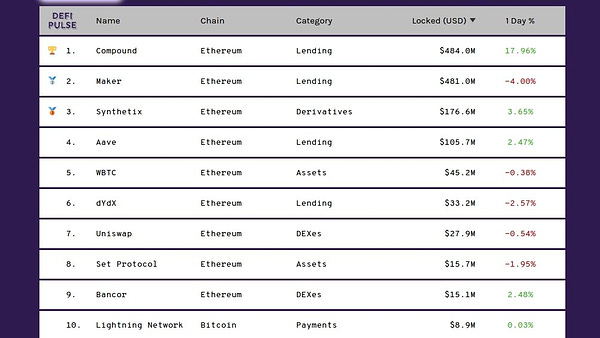

How Nyctale - DeFi, yield farming and governance tokens can Save You Time, Stress, and Money.With a mindful technique and ideal background understanding, it is possible to keep the risk of loss to a minimum, however not eliminate it altogether. An useful comparison is that of the preliminary coin offering (ICO) trend from 2017, which infamously penalized opportunist investors who put capital into projects without extensive understanding of their validity as financial investments. Prior to sending out a message to us, kindly keep in mind that we do not accept demands for funding. Thank you for your understanding.  In short Yield farming lets you lock up funds, supplying benefits at the same time. It involves lending out cryptos by means of De, Fi protocols in order to earn fixed or variable interest. The benefits can be far higher than conventional financial investments, but greater rewards bring higher dangers, especially in such an unstable market.  The smart Trick of DeFi & Yield Farming Crypto Tax Guide - CoinTracker That Nobody is Talking AboutOne of the most recent ones you may have come across just recently is yield farminga benefit scheme that's taken the decentralized finance (De, Fi) world by storm during 2020. Arguably one of the main reasons individuals are drawn to the De, Fi world, yield farming has actually seen unskilled financiers get burned and tech-savvy capitalists making their fortunes.  So what is yield farming and what does it indicate for the world of crypto? Without more ado, let's dive in. What is Find More Details On This Page ? At its core, yield farming is a process that allows cryptocurrency holders to secure their holdings, which in turn provides them with rewards. More particularly, it's a procedure that lets you earn either fixed or variable interest by investing crypto in a De, Fi market. When loans are made via banks using fiat money, the amount lent out is repaid with interest. With yield farming, the principle is the very same: cryptocurrency that would otherwise be sitting in an exchange or in a wallet is provided out via De, Fi procedures (or locked into wise agreements, in Ethereum terms) in order to get a return. The Ultimate Guide To DeFi - The Decentralized Finance Leaderboard at DeFi PulseWhile this might alter in future, almost all existing yield farming deals take location in the Ethereum community. How does yield farming work? The first action in yield farming includes including funds to a liquidity swimming pool, which are basically smart agreements that consist of funds. These swimming pools power a market where users can exchange, borrow, or lend tokens. |

||

|

||