|

|

|

|

|

|

| Topics >> by >> how_to_boost_your_credit_sco |

| how_to_boost_your_credit_sco Photos Topic maintained by (see all topics) |

||

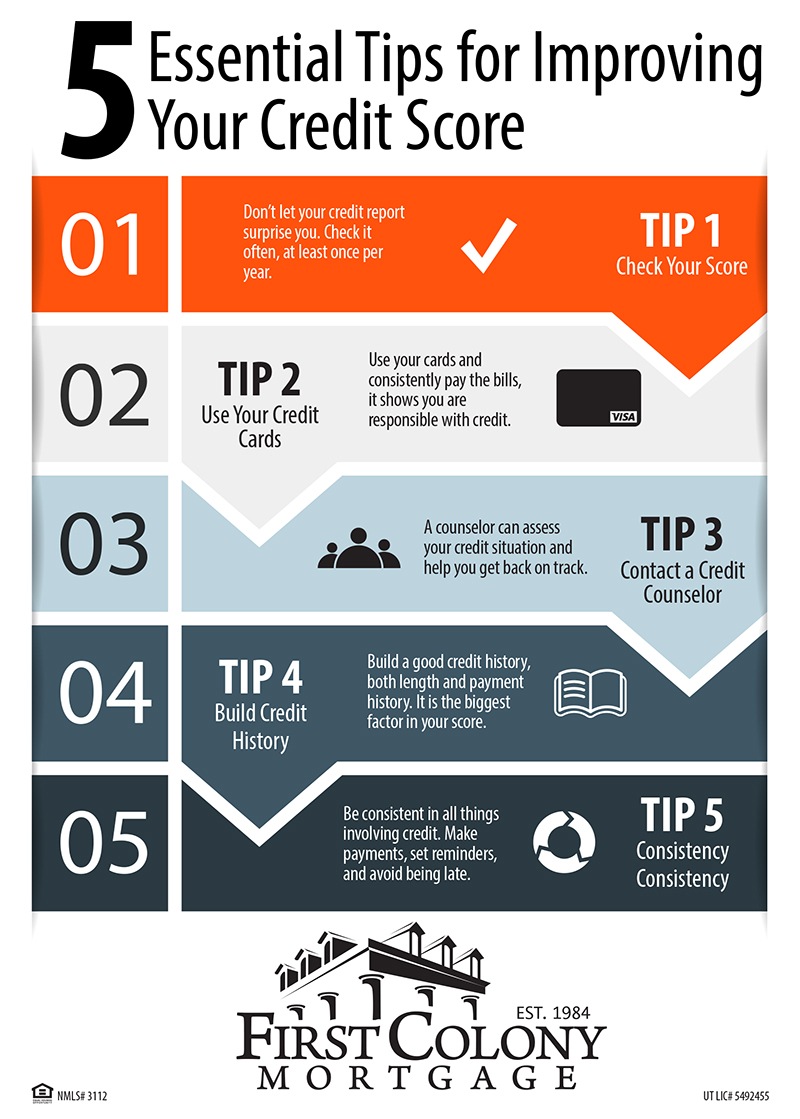

The smart Trick of 6 Ways to Boost Your Credit Score -- Fast - Kiplinger That Nobody is DiscussingBecause credit is so complicated, constructing credit takes some time. Depending on your private scenario, there might be ways to raise your scores quickly like paying for all your financial obligation in a really short span of time. But if you're starting with bad credit, even a drastic measure like that might not have the instant result you're searching for. Here are some tips that can help you raise your credit ratings in time. No matter where you turn for your credit check-in your bank, Credit Karma or one of the major customer credit bureaus it is very important to watch on your credit. And if you find any mistakes or inaccuracies, we can assist you file a disagreement. Whether it's with Credit Karma or somebody else, keeping a close eye on your credit is necessary. Signing up for credit tracking can assist notify you to crucial changes in your credit, so that you can examine for suspicious activity. Fraudulent activity can weigh down what might be an otherwise good credit rating, so it is necessary to contest any information you recognize as incorrect.  Gather all your bills and come up with a plan to pay them off. The snowball method concentrates on paying off the most affordable balances initially, while the avalanche technique concentrates on settling the balances with the highest rates of interest initially. If you have too many charge card to monitor, you might also consolidate your credit card debt into one balance transfer card to make it much easier to manage your regular monthly payments.  The Definitive Guide for 15 Best Credit Repair Companies: Raise Your FICO ScoreSo, select the strategy that works best for you, and persevere. This might help you establish a consistent payment history over time. The Latest Info Found Here may not help you raise your credit history fast, but it could safeguard your ratings from declining fast, which will likely happen if you miss a payment.  This could help you sneak in a couple of additional payments each year and conserve money on interest charges. And the extra payments can assist pay for your principal balance faster, reducing your account balances and credit usage ratio, which can raise your scores. A lower rate can help you pay off your balance quicker, because more of your payment can be applied to your principal balance than interest. |

||

|

||