|

|

|

|

|

|

| Topics >> by >> fascination_about_what_is_yi |

| fascination_about_what_is_yi Photos Topic maintained by (see all topics) |

||

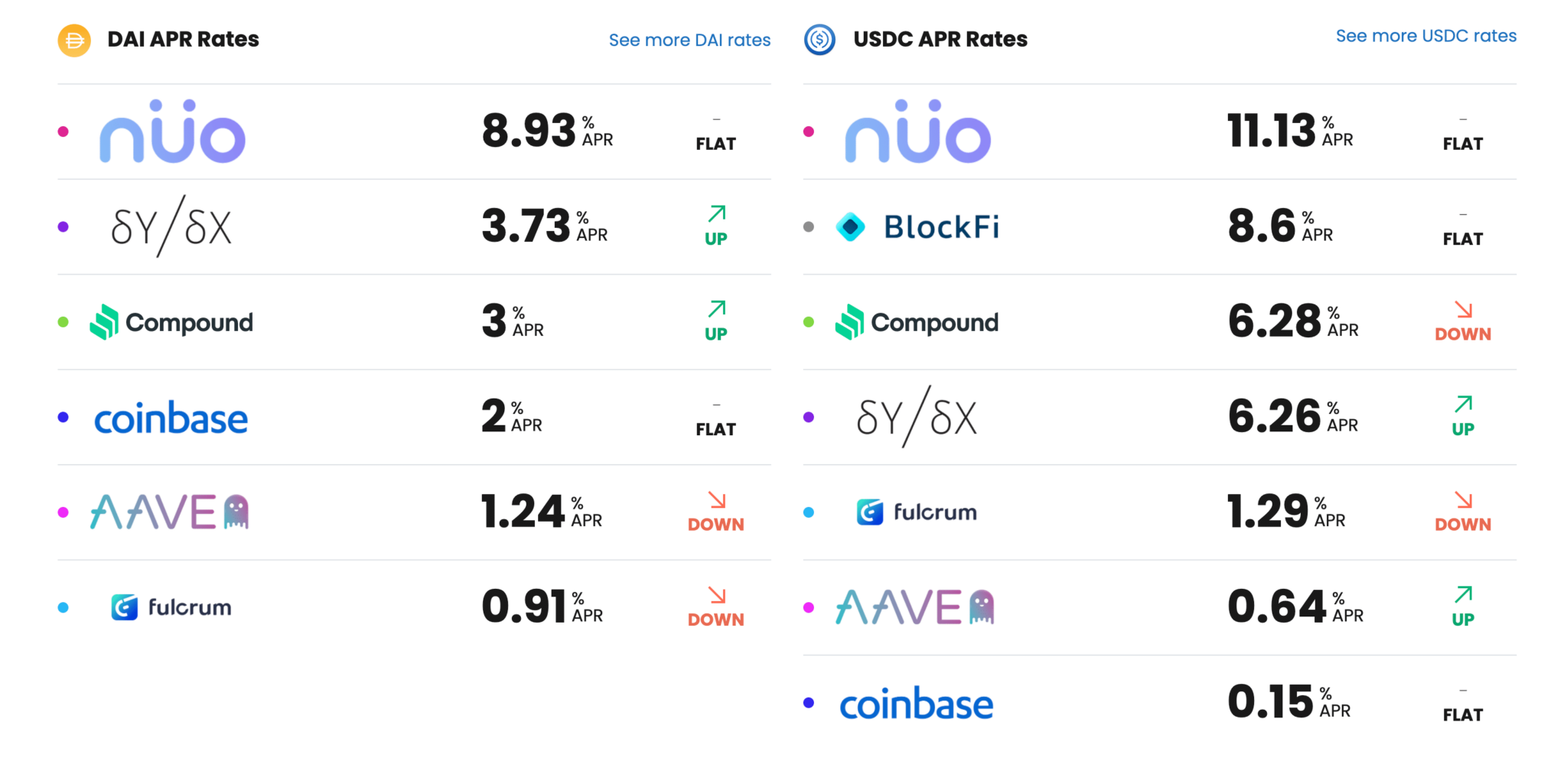

The Best Guide To ahmetozlu/defi_yield_farming: A DeFi app, which - GitHubWhat Is Yield Farming? De, Fi is the talking point of the cryptocurrency industry in 2020, and yield farming is financiers' go-to approach of taking part in the trend. Coin, Market, Cap provides a newbie's guide to yield farming and just how much is at stake by supplying your hard-earned coins to De, Fi platforms in return for monetary benefits. De, Fi Yield Farming Explained For Beginners Yield farming is a brand-new way of making money with cryptocurrency that has become a major phenomenon this year. From its abrupt explosion in the summer of 2020, yield farming one of the main investment techniques related to the decentralized financing (De, Fi) motion has actually developed a big community and produced excessive amounts of value in a matter of months.  Some Known Details About DeFi yield farming, explained - CointelegraphDe, Fi allows anybody to participate in all sorts of monetary activities which previously required relied on intermediaries, ID confirmation and a lot of fees anonymously and totally free. One example revolves around loans. Someone installs cryptocurrency for another to obtain, and the platform this occurs on rewards them for doing so. The combination of these benefits, combined with the truth that the rate of these internal tokens is free-floating, enables for the prospective success of lending and even obtaining to be considerable. The practise of putting cryptocurrency to operate in in this manner, often in numerous capacities simultaneously, is what is called yield farming.  How What are DeFi and 'yield farming': an explanation of crypto's can Save You Time, Stress, and Money.The environment is expanded with automated trading markets computer systems managing "swimming pools" of tokens to guarantee that there is liquidity for any provided trade that token holders want to make. Uniswap is among the finest understood of these "automated liquidity procedures." Curve is an example of a decentralized exchange which concentrates on stablecoins such as Tether (USDT), and has its own token which debtors and lenders can get as a reward for participation providing liquidity.  The yield farming design includes fundamental risk which varies depending on the tokens utilized. In the loan example, cost considerations consist of the initial cryptocurrency installed by a lending institution, the interest and the worth of the internal governance token reward. Check it Out that all 3 are free-floating, the profit (or loss) potential for individuals is significant. |

||

|

||