|

|

|

|

|

|

| Topics >> by >> what_does_torontodominion_p |

| what_does_torontodominion_p Photos Topic maintained by (see all topics) |

||

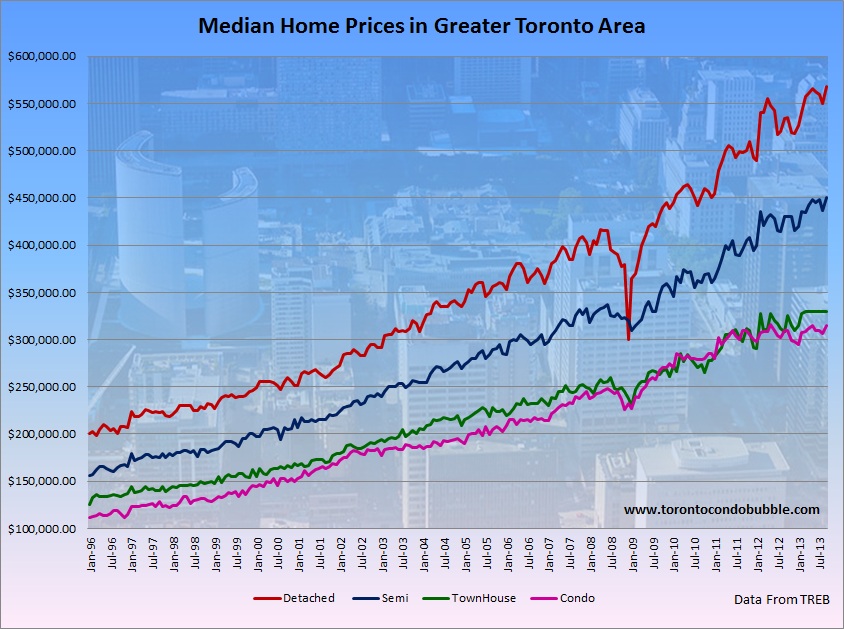

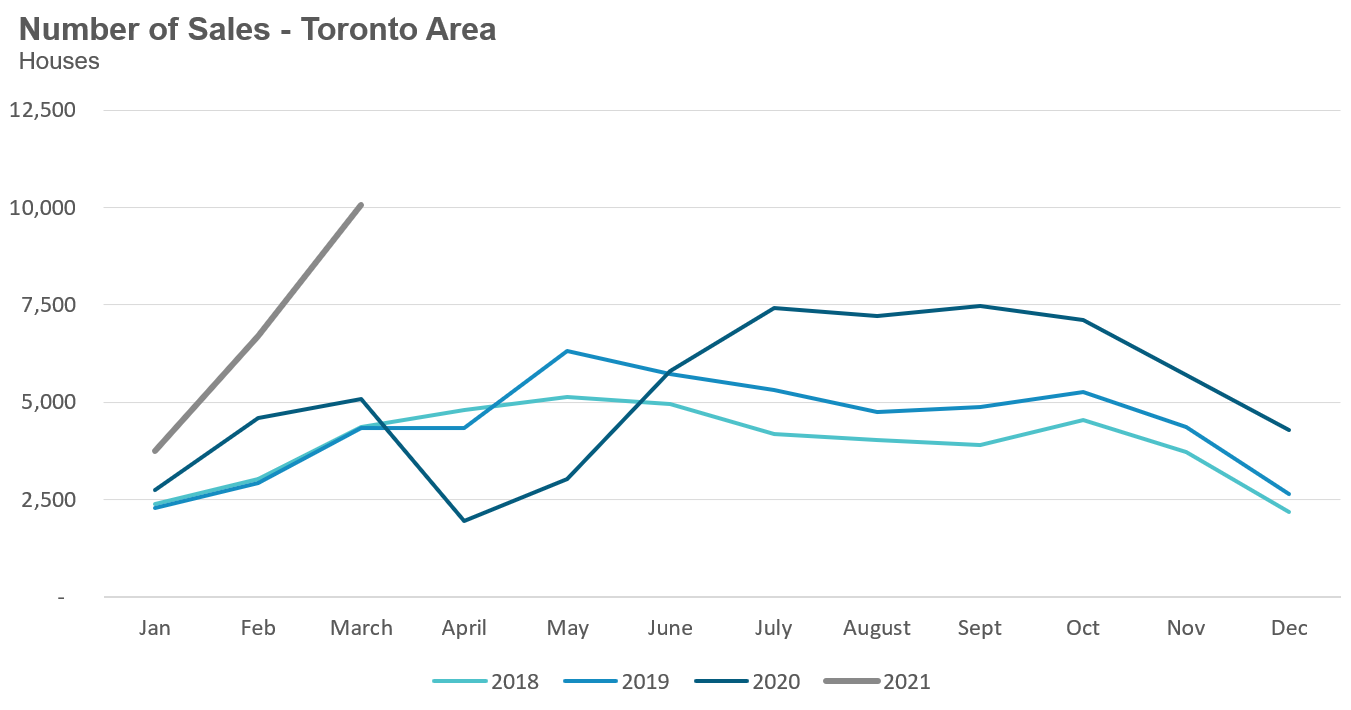

Toronto-Dominion Profit Gets Boost From Canadian Housing Things To Know Before You BuyAnd still, home costs increase and rise. In October, home sales throughout the country increased 8. 6 percent in a single month. Rates rose 2. 7 percent on the month, and 23. 4 per cent on the year. It's not a one-month marvel. In November, house rates in Toronto rose four per cent, according to the Toronto Regional Realty Board on Friday. It's been a continuous gold mine for sellers and those who own houses as investment cars. However it's a deal-breaker for those who are attempting to move better to work, establish a brand-new life in Canada, transfer to the big city or broaden to deal with a growing household. Find More Details On This Page to this is to blame an insufficient supply of housing, turn public policy towards bolstering the building of more houses and hope the marketplace does its thing. To wit: The worth of building permits for homes is mainly flat over the course of the pandemic, regardless of some month-to-month volatility, Data Canada information programs. In the most current report on gross domestic item the broadest step of how the whole economy is faring it's clear that investment in construction and real estate plunged in the third quarter.  This market stress is about to come face to face with two federal realities: rising rates of interest and parliamentary politics. With inflation increasing (partially associated to the heat in the real estate market), the Bank of Canada has actually signified its intents to start raising its benchmark interest rate by the middle of next year, with some forecasters forecasting even earlier.  Real Estate News - CP24 for DummiesOver the medium term, increasing rates might change the market dynamic and cool down housing markets, Jean says. However the instant impact will be to make it harder for first-time buyers to get approved for home mortgages, intensifying their problems, he says."It's difficult to see rates coming down at this stage," he includes, especially offered the low inventory of homes for sale. |

||

|

||