|

|

|

|

|

|

| Topics >> by >> getting_my_y_combinator_alum |

| getting_my_y_combinator_alum Photos Topic maintained by (see all topics) |

||

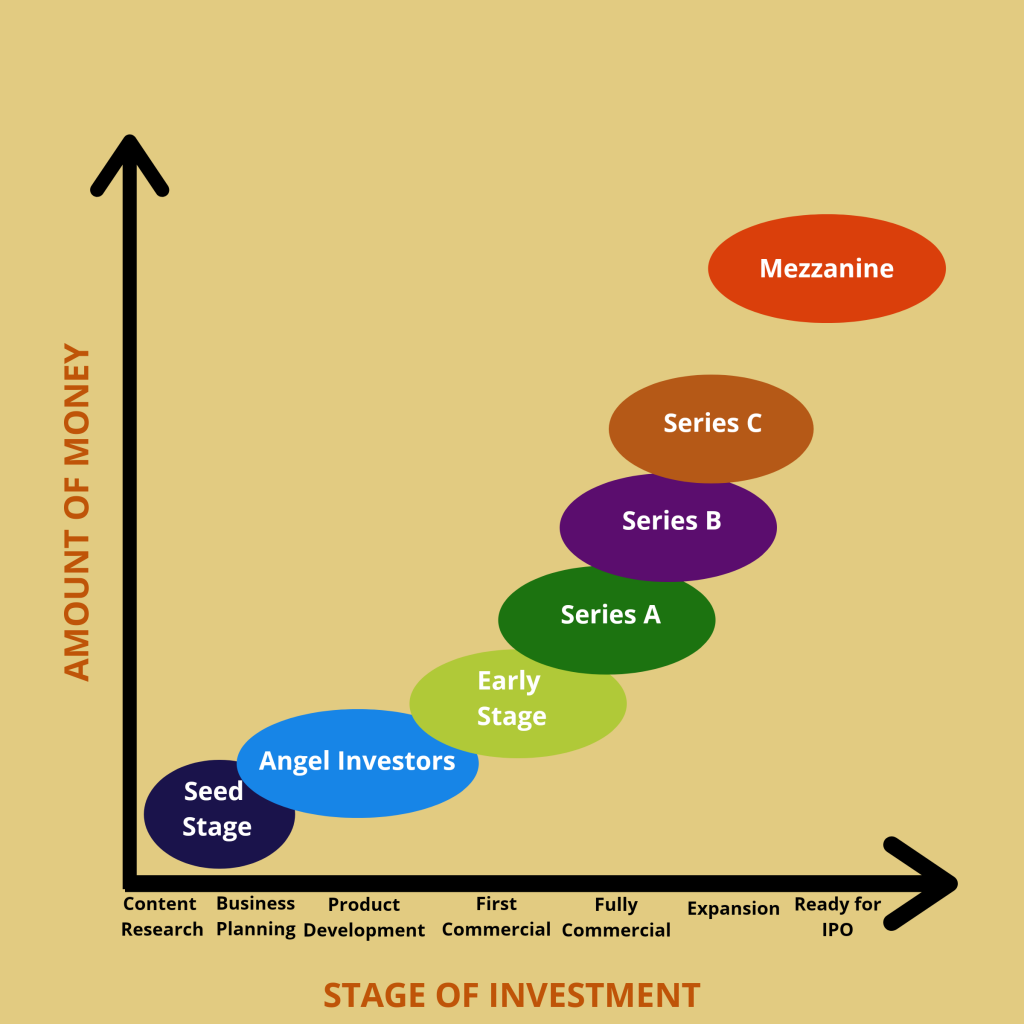

All about Intellimize Raises $30M In Series B Funding - Demand GenTabulation What is Series A Financing? Series A financing, (also called Series A financing or Series A financial investment) indicates the first equity capital funding for a start-up. The Series A financing round follows a startup company's seed round and precedes the Series B Financing round. Check Here For More refers to the class of favored stock sold. Aside from the funding being much larger than a seed round, business require to demonstrate they have a minimum feasible product (MVP) to obtain an A round - and not simply an excellent concept or team. It is not easy for seed funded companies to graduate to a Series A funding round. A Biased View of Announcing ChartHop's Series B Funding - BlogA Series An investment offers investor, in exchange for capital, the first series of preferred stock after the common stock provided throughout the seed round. Usually speaking, a Series A funding supplies as much as a couple of years of runway for a start-up to develop its products, team and start to perform on its go-to-market technique.    funding information): The mean Series A funding round has grown progressively throughout the years and is currently at around $22. 3 million, of July 31, 2021. [1] Financial investment activity has actually increase significantly in the first half of 2021. For example, for the week ending March 13th 2021, there were at least 23 Series A deals, yielding over a half a billion dollars in endeavor funding.  Little Known Questions About Series B Financing Definition and Example - Investopedia.In 2021, the average early phase financing, which includes Series A & B, is around $8 million. The substantial disparity between the mean and typical exists because of an increasing quantity of "mega-rounds", particularly amongst biotech start-ups. There were about 650 Series A deals in the U.S. in 2020. Typical Series A Start-up Evaluation in 2021: Series A start-ups currently have a median pre-money assessment of around $24 million. in 2020. Around one-third of start-ups that raise Series A funding go through an accelerator and the leading 3 accelerators represent 10% of all Series A rounds. The # 1 factor examined for approval into leading accelerators is your team. When fundraising, your network is important. While joining a top-tier accelerator provides you the best analytical possibility for success in ultimately getting a Series A financing, these groups only accept about 2% of candidates. |

||

|

||