|

|

|

|

|

|

| Topics >> by >> fein_ein_federal_tax_id |

| fein_ein_federal_tax_id Photos Topic maintained by (see all topics) |

||

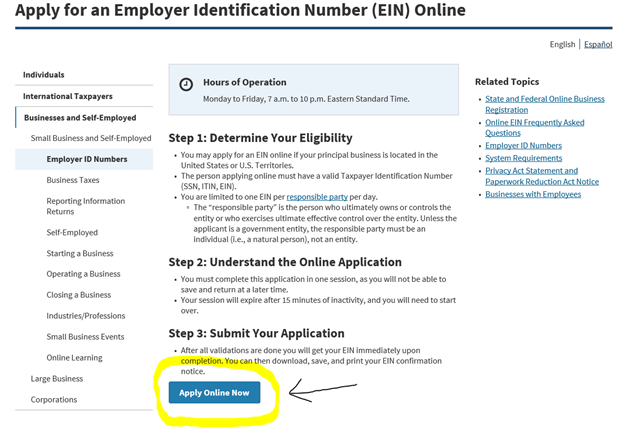

Excitement About TIN Description US taxpayer identification numbers i - OECDThis private or entity, which the internal revenue service will call the 'responsible celebration', controls, handles, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a federal government entity, the responsible party must be an individual (i. e., a natural individual), not an entity.". INFORM ME MORE Benefits of getting an EIN Different your Financial resources An EIN allows the internal revenue service, banks, credit card business and other entities to track your business and individual financial resources individually. Open a Savings Account Banks and cooperative credit union need an EIN to open a savings account and it's also valuable when attempting to get funding for your company. The Buzz on EIN Comprehensive Guide - FreshBooksWhy do I require a Company ID Number (EIN)? An Employer Identification Number (EIN), likewise called a Tax ID Number, is a 9-digit code assigned by the IRS to determine your organization. You can believe of it as the social security number for your company. An EIN is needed for a partnership, corporation, or LLC to open a company savings account, gain financing, work with employees, and more.   It is extremely motivated that you get a federal EIN number and open a different company savings account so you can keep your service and individual transactions different. Other key factors to get an EIN An EIN develops your company as a separate entity, which maintains limited liability must your company ever be sued. What Does Preparer's Employer Identification Number (EIN) - FAFSA Mean?A company identification number (EIN) is like a Social Security number (SSN) for an organization. The IRS appoints an EIN to any service, including a sole proprietorship, that is eligible to obtain one. EINs aren't always essential, but we'll stroll you through why having one can benefit your organization and how to do an EIN lookup when you can't find yours.  The IRS requires any authorized service that has employees or is a corporation or collaboration to have one. Your EIN acts as the main ID of an organization to the government. It's also commonly referred to as a "tax identification number (TIN)," "95 number" or "federal tax ID." Find More Details On This Page is frequently utilized for the following reasons: Obtaining an EIN is easy; it can be done online within minutes on the IRS website through kind SS-4. |

||

|

||