|

|

|

|

|

|

| Topics >> by >> the_applying_for_auto_insura |

| the_applying_for_auto_insura Photos Topic maintained by (see all topics) |

||

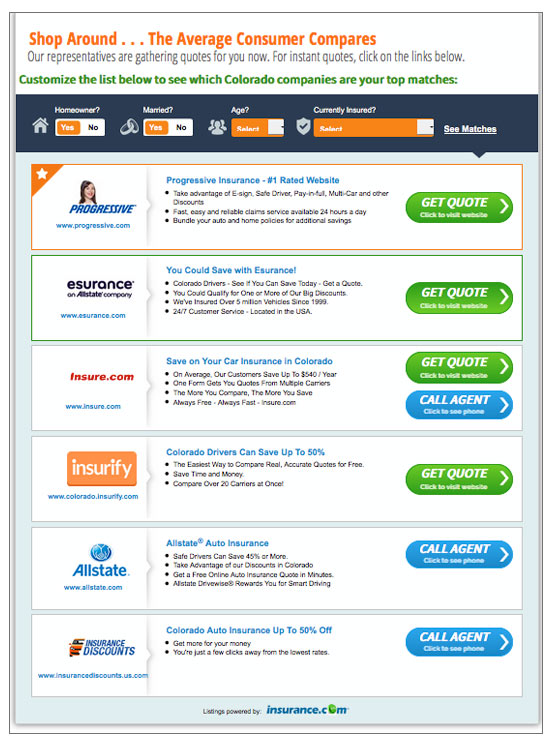

The smart Trick of Auto Insurance: Common Myths That Nobody is Talking AboutIf you have a cars and truck, you require automobile insurance. The majority of U.S. states need motorists to have a minimum amount of automobile insurance, and it's an excellent idea to have, anyway, since it can protect you financially if you enter into an accident. You can purchase car insurance in one of 2 methods: straight from an insurance coverage company or through an independent insurance market like Policygenius. You'll also conserve time and cash in the insurance coverage buying process, since somebody will be there to answer your concerns and assist you find the best coverage at the most affordable cost. The five easy steps to buying cars and truck insurance: Find out how much coverage you need, Complete an application, Compare quotes, Choose a cars and truck insurer and get insured, Cancel your old policy 1. A common policy consists of:Liability coverage: Covers the costs if you cause a mishap, including when you harm somebody else's property with your cars and truck. Liability insurance coverage is required in the majority of states, and it's divided into two parts: Physical injury liability (BIL) and residential or commercial property damage liability (PDL)Injury security: Covers medical and rehab expenditures if you or your passengers are hurt in a cars and truck accident.   Some Known Facts About HealthCare.gov: Get 2022 health coverageHealth Insurance.Each state has minimum cars and truck insurance protection requirements. insurance claim process for car accidents are a starting point for figuring out protection however often they're too low to sufficiently cover you in the occasion of a major mishap. Genius tip, We recommend motorists have at least $100,000 per person/$ 300,000 per accident in physical injury liability and $100,000 in property damage liability coverage in order to be completely safeguarded. 2. Fill out an application, Whether you're purchasing cars and truck insurance coverage for the first or tenth time, you'll need the following information on hand: Names, birthdays and chauffeur's license numbers for all motorists in the household, Social Security numbers for all drivers in the home, VINs (Car Info Numbers) or make and model years for all vehicles, An address for the guaranteed (where you live and where the automobile is garaged, which is generally the very same location) Your declarations page from your latest previous car insurance coverage policy, if you have it, As you go through the process, you'll address concerns that can help make you discount rates on your coverage, like whether you have any accidents or offenses on your record, whether you're a full-time trainee, and if your automobile is equipped with certain features like an anti-theft gadget. |

||

|

||