|

|

|

|

|

|

| Topics >> by >> how_prepping_for_2021_ccar_a |

| how_prepping_for_2021_ccar_a Photos Topic maintained by (see all topics) |

||

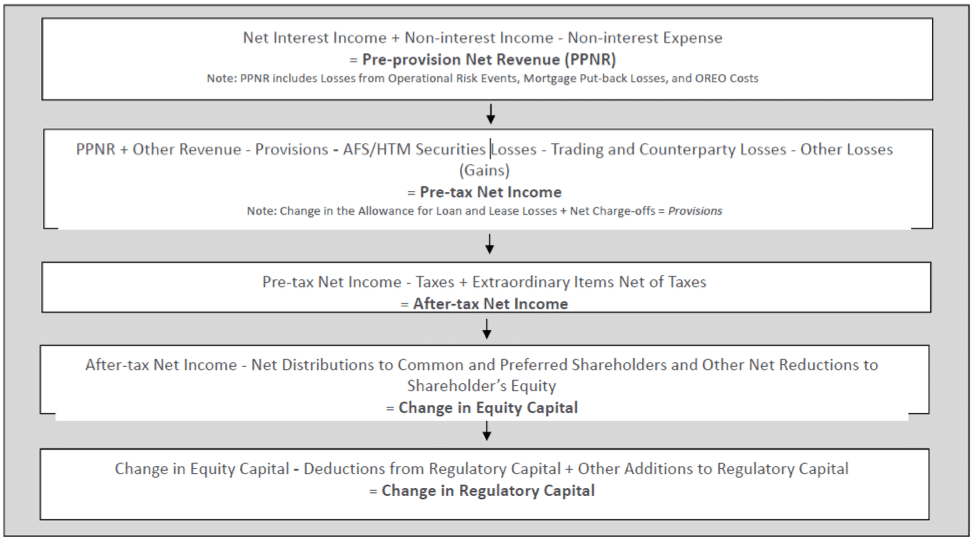

8 Easy Facts About CCAR - Jewish English Lexicon DescribedThis second CCAR submission will be evaluated versus brand-new variables which have actually not yet been released. The brand-new submission will be required within simply 45 days from the release of the variables. In the meantime, the FRB will suspend share repurchases and cap dividends. It was likewise stated that the FRB might continue these constraints on a quarter-by-quarter evaluation basis as conditions unfold.  During this call, it was concurred that the finest method to support our CCAR community was to launch the outcomes of our annual CCAR standard earlier than planned. This suggests the findings will be offered prior to the FRB's release of the brand-new variables. The Most Complete Run-Down of the CCAR criteria will receive the full report and specific factsheets and we'll launch a public summary of the results. This study will briefly cover changes made to banks' CCAR submissions and go over preparations going into 2021. Much of the content will depend upon the variables the FRB releases and any outcomes and lessons gained from this 2nd submission. This standard is open to our members and non-members alike, so if your company goes through CCAR please do contact us to discover more.  3 Easy Facts About Prepping for 2021 CCAR ahead of LIBOR cessation - Accenture ShownThere are 2 parts to the test the quantitative and the qualitative evaluation. The quantitative part of the evaluation takes a look at a firm's ability to hold capital ratios above the regulatory capital requirements through demanding conditions throughout their preparation horizon. The qualitative part looks at internal practices, such as recognizing threats, executing strong controls, and oversight, with a concentrate on the overall strength of risk management within the firm. Who needs to do the tension test? The FRB has created a grouping of banks based upon asset worth and intricacy. There are 5 categories, 4 of which submit for CCAR. The banks in these 4 classifications have a possession value greater than $100bn. In 2020, 33 banks were needed to submit. For instance, classification 1 firms are the highest possession value and most complex and go through the greatest level of scrutiny and requirements, while classification 4 firms submit to CCAR however have less requirements than the other categories.  The 15-Second Trick For Courageous Conversation CertificationAboutPressCopyrightContact usDevelopersMarketDevelopersTermsPersonal privacyPolicy & SecurityHow You, Tube worksEvaluate brand-new functionsCCAR - You, Tube. |

||

|

||