|

|

|

|

|

|

| Topics >> by >> biden_prepares_to_eliminate |

| biden_prepares_to_eliminate Photos Topic maintained by (see all topics) |

||

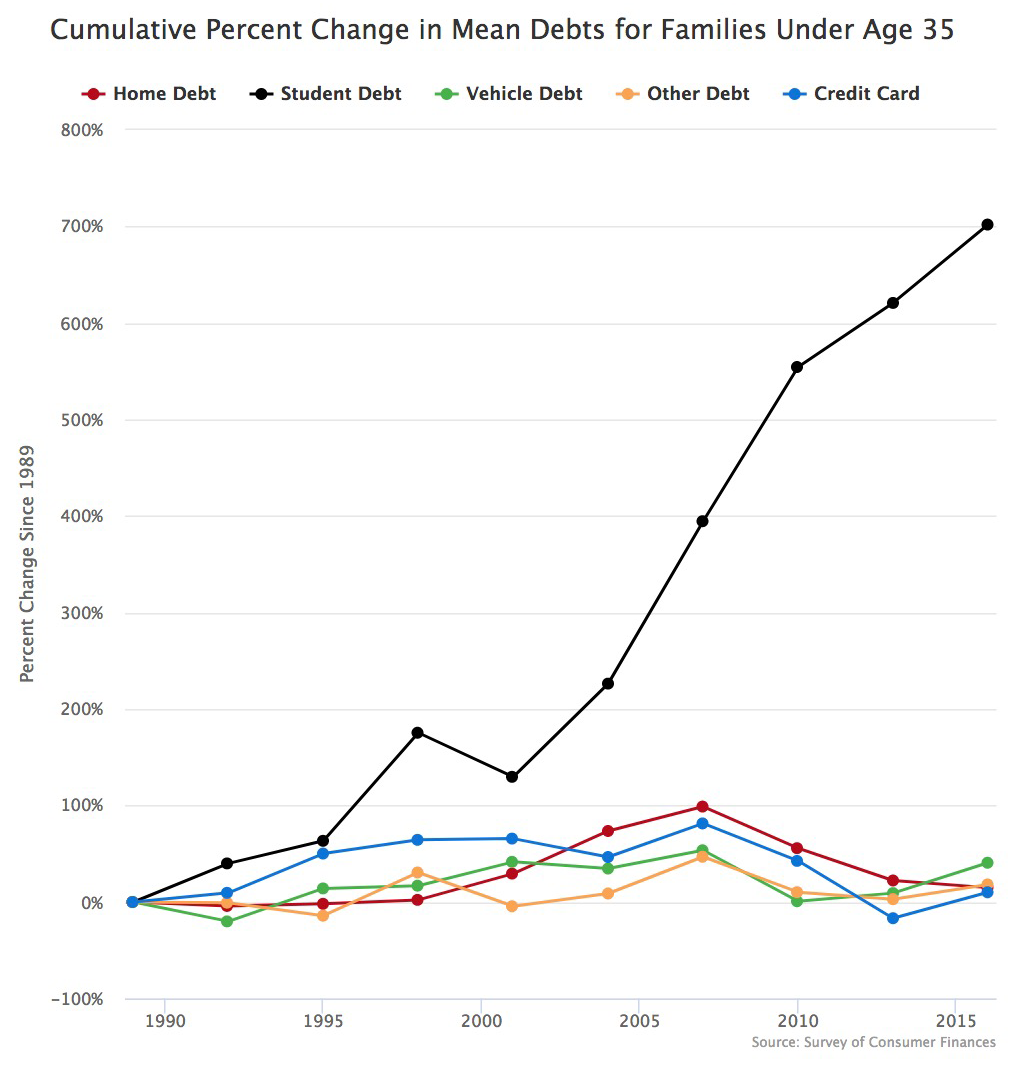

All About 'No such thing as a free lunch.' Canceling student debt couldAdvertisement It's no surprise that the President Joe Biden is dealing with pressure to cancel existing trainee loan debt, either in part or completely. Approximately 92% of student loans are released by the federal government, while the remaining 8% are funded by personal financial institutions like banks and cooperative credit union. Biden has said he wishes to pass legislation that would forgive a portion of student loan financial obligation. "Nevertheless, he has suggested that he would likely not pass loan forgiveness by means of executive action, so he would require to get Congress on board with these strategies."Now that Democrats have a minor majority in the Senate, some form of loan forgiveness is looking more most likely, Safier kept in mind, which could do a lot to relieve the financial burden on indebted debtors.  However regardless of the financial advantages of student loan forgiveness, there are some possible disadvantages, too. Here's a take a look at what might take place if Biden forgives student loans. One of the greatest advantages of canceling federal student loans is that lots of people could begin living their lives more completely. As Barrington discussed, student loan debt is accountable for putting many borrowers' goals on hold. Top Guidelines Of What Should the U.SDo About Rising Student Loan Debt?This includes conserving for emergency situations (which 38% of participants stated they 'd delay), home purchasing (31%), settling other financial obligation (28%), purchasing or leasing an automobile (28%), conserving for retirement (25%), having children (19%) and getting married (17%). And we're not just speaking about 20-somethings simply getting begun in their careers; millennials are primarily in their 30s now. If trainee loan debt is forgiven, borrowers might also end up being customers overnight, according to Travis Hornsby, creator and CEO of Trainee Loan Planner. "Envision if you awakened one morning and a multi-year responsibility that required a considerable contribution from your earnings was all of an abrupt gone," he stated.  Removing that month-to-month debt responsibility would belong to sending out a stimulus check monthly. And considering that a lot of Americans would unexpectedly have additional money in their pockets, they could utilize it to buy items, financing homes and invest in the stock market. Source 's a win for all Americans, not just student loan borrowers. |

||

|

||