Content create by-Lindsey Pilegaard

There are dozens of stories about families who lost one of their primary earners and found themselves in a horrible financial situation. Many people are scared to even think about life insurance, but you can insure that your family will not be lost without you if you just follow these tips.

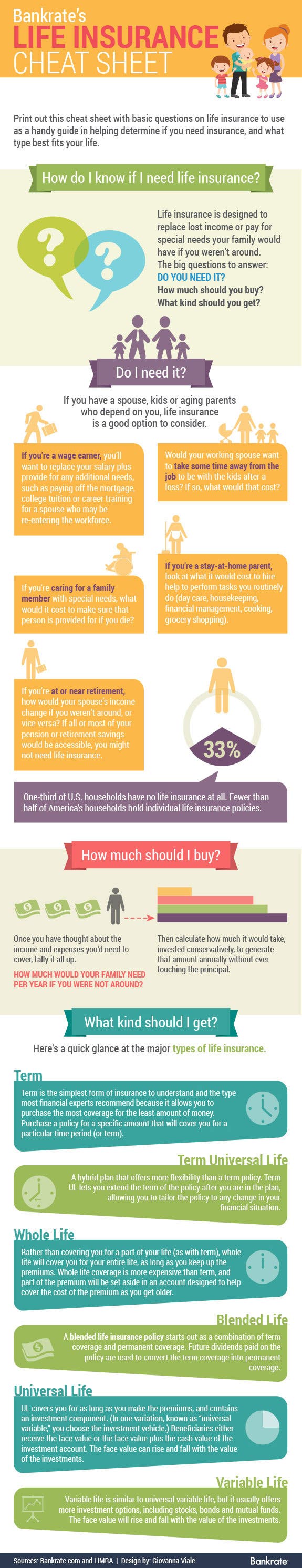

Understand the types of life insurance available before making a decision on which to purchase. Most insurance policies focus on Term Life or Whole Life and knowing the difference is key. Bear in mind that with both of these types of policy, they can be tailored to your specific needs and situations. Do your homework.

When choosing a life insurance policy, look into the quality of the company you choose. The company that holds your policy should be able to stand behind it. It is good to know if the company that holds your policy will stay around to service the policy if need be and eventually be around to pay the benefits of the death.

Lower the cost of life insurance by quitting smoking. Smoking is one of the biggest health risk factors from an insurance standpoint, but some life insurers will reduce your rates with just one year of being smoke-free. After two to three years of non-smoking status, some insurance companies will put individuals into the standard rate class, reducing premiums substantially.

A person should not wait until they are sick to consider life insurance. Many preexisting conditions can make you ineligible for a life insurance policy. If https://www.usatoday.com/in-depth/news/investigations/2020/07/02/reverse-mortgages-puerto-rico-retired-seniors-face-foreclosure/5217044002/ are eligible, premiums will likely be higher than they would be for a healthy individual. Taking out a policy while you're healthy is the best way to protect yourself, and your family.

Obtain a term insurance plan instead of a whole life permanent plan. The latter will last until the holder of the policy dies. The other is obtained for a certain period of time or until you reach a certain age. just click the up coming web site is the least expensive policy that you can get because the premiums remain the same while its held.

You need to know what your debts are before getting life insurance. In order to find out home much life insurance coverage you need you first have to know the amount of your debts and how much your funeral will cost. Your life insurance policy needs to be higher than that amount.

If you want to have some control and decision-making power over the money you invest in your life insurance, consider a variable, universal life insurance policy. With these policies, you have the ability to invest part of your premium in the stock market. Depending on how wisely you invest this portion of your money, your death benefit can increase over time. You should have some knowledge of the stock market if purchasing this type of policy or enlist the aid of a financial professional.

If you have an old whole-life policy that you've had for several years, you should not attempt to replace it. The reason is because you could lose the premiums you have paid, and you could have to pay new administration fees. If you need more insurance on a whole-life policy, then you should just purchase more instead of discarding your current policy.

Make sure you pay your life insurance premium payments on time. While most companies allow a grace period for late payments, consistent late payments can reduce your available cash value or result in policy cancellation. Depending on your age and health, getting a policy reinstated or finding a new one could be much more expensive than your original policy.

You have a lot of options when it comes to the type of life insurance you will purchase. Depending on your age, your level of coverage needed and your budget, you will need to have your insurance agent or representative explain these to you in detail. Make sure to ask lots of questions, don't just take their word for it.

One tip when purchasing life insurance, always tell the truth about your health issues. Even if you are able to make it through the medical tests and reviews done by the insurance company and get the policy issued, it is not a good idea. Insurance companies investigate claims and if they suspect your information is not valid, the claim will not be paid and your heirs could be tied up in court for years.

If you are about to get divorced, you should change your life insurance so that it reflects your new lifestyle. Perhaps you do not wish your ex-spouse to benefit from your life insurance: make the necessary changes to your policy. Ask your ex-spouse if he or she has a life insurance policy to make sure that your children will be well taken care of.

If you are buying a life insurance policy for the first time, remember that insurance is for protection, not for investment. Term insurance provides only protection without a savings component, and is therefore much less expensive than whole or universal life insurance policies. It is almost always better to purchase term insurance.

Speak with your family about purchasing life insurance in order to reach the best decision. Nobody wants to think about death like this, but you must broach the topic and find out what the needs of your family are. In this life, it is very important to always be prepared for these types of things.

If your current term insurance is going to expire soon, be proactive. Look for another term life policy if your health is still good. If your health is not good, switch from term life to a permanent life policy. You can stay away from taking a medical exam by doing this, and later on in life a permanent life insurance policy can cost less than a term life insurance policy.

Never pay the life insurance agent instead of the company. If you are not sending your check directly to the company itself, something is wrong. No reputable agent will ask you to write a check out to them. If they do, stop communicating with them, and move on to a more reliable person.

Before you subscribe to a life insurance, you should carefully go over the policy. If you do not understand everything on your policy, have a professional explain it to you. If you notice anything unclear or that is not going to work at your advantage, you should probably consider another insurance company.

As stated in the article from above, buying life insurance can be compared to gambling. Gambling with your family's well-being is never a safe bet!

|