|

|

|

|

|

|

| Topics >> by >> apply_for_ein_employer_ide |

| apply_for_ein_employer_ide Photos Topic maintained by (see all topics) |

||

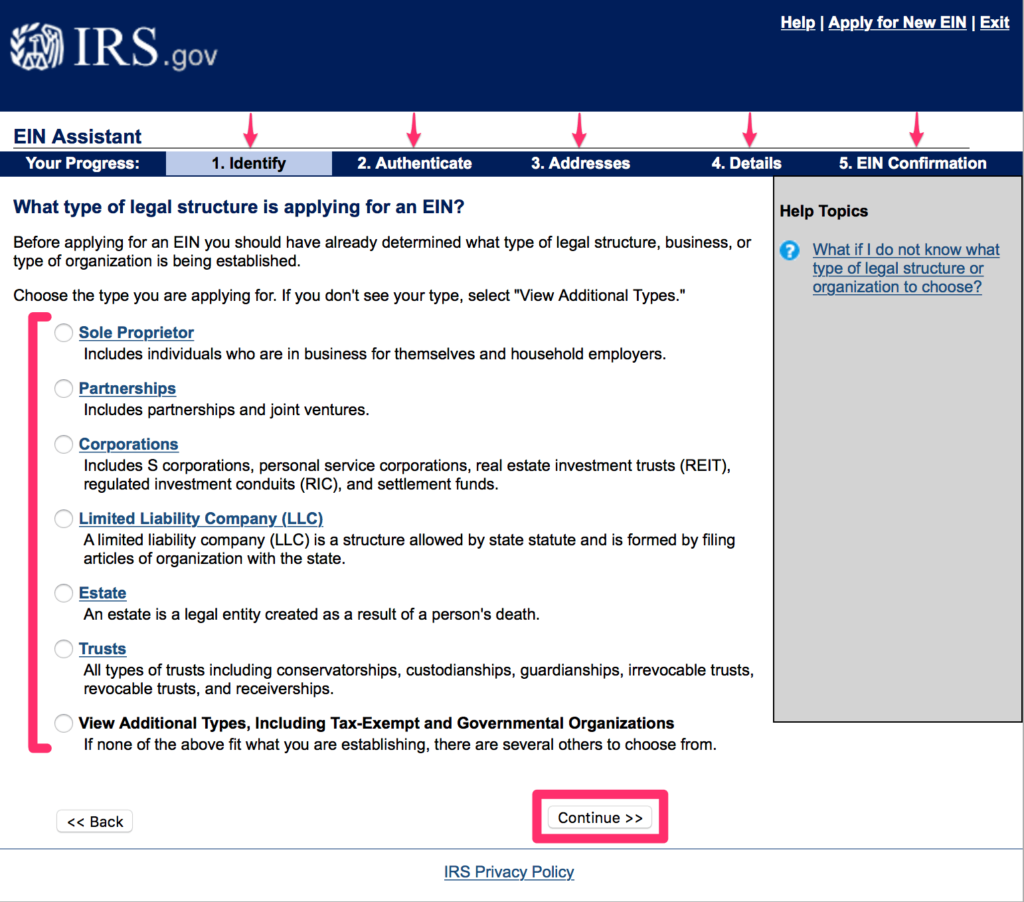

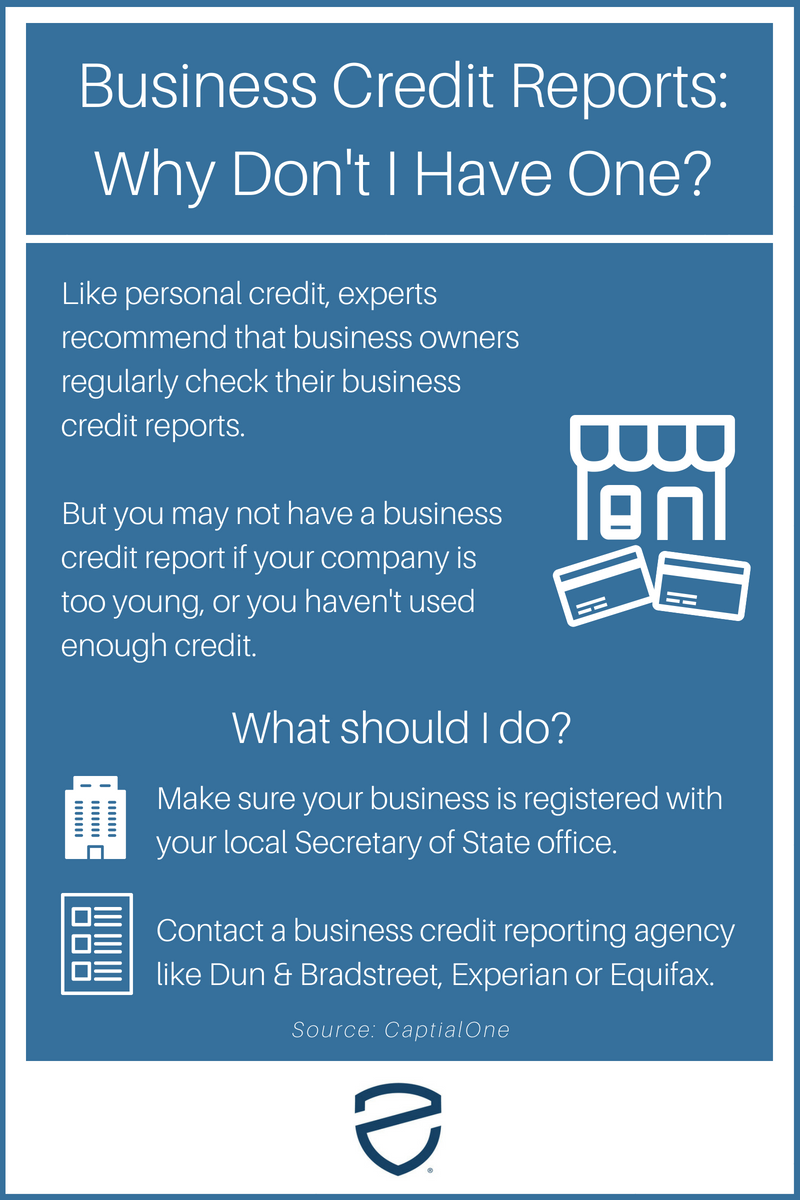

Examine This Report about Get an EIN Number for Your LLC or Corporation - ZenBusinessAs soon as your service is formed, you may request an EIN number. The IRS will request your organization structure and development date on the application. You can make an application for an EIN number online through the internal revenue service site which you can reach by clicking here. There are some exceptions to who is eligible for processing an online application that the IRS site linked above will clarify. As we discussed above, not all TIN alternatives use to businesses, and not all organizations require an EIN. If Also Found Here are a sole proprietor or single-member LLC, you are eligible to use your social security number as your TIN. If you have a multi-member organization structure or dream to secure your identity and avoid the usage of your Social Security number, you are qualified for an EIN.  How to Apply for an Employer Identification Number (EIN) for Dummies Unless the applicant is a federal government entity, the accountable celebration needs to be a person." Keep in mind: there can only be one responsible party per EIN. So You've Gotten Your EIN, What's Next? Now you know what an EIN number is, what EIN represents, and for how long it takes to get an EIN. If you've taken the necessary actions to get your EIN, you may be believing, now what? After you have gotten your EIN number it's time to begin gathering the needed pieces to forming a main organization. Now, it may be time to: Beginning a new company is an interesting endeavor, and these information comprise the less glamorous side of entrepreneurship.  Federal Employment Identification Number (EIN) - King Can Be Fun For AnyoneA Company Recognition Number (EIN) is a special nine-digit identification code issued by the Internal Profits Service (INTERNAL REVENUE SERVICE) to a service. An EIN follows the format 12-3456789. It is used for submitting income tax return, opening a bank account, and hiring employees. Synonyms An EIN passes lots of names. All the following refer to the very same ID for your business: Company Recognition Number (EIN) Federal Company Identification Number (FEIN) Federal Tax Recognition Numbers (TIN) What is an EIN Used For? Although it's called a Company Identification Number, an EIN is not simply for business that have employees. |

||

|

||