|

|

|

|

|

|

| Topics >> by >> the_business_owners_insuranc |

| the_business_owners_insuranc Photos Topic maintained by (see all topics) |

||

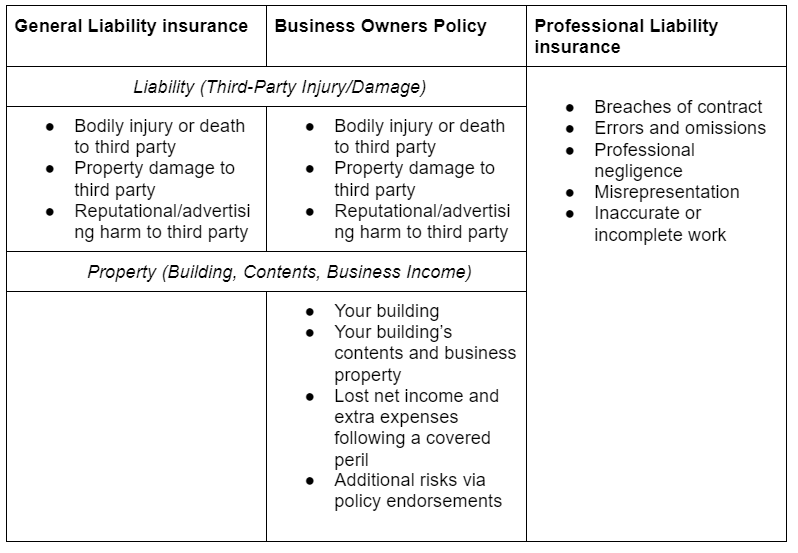

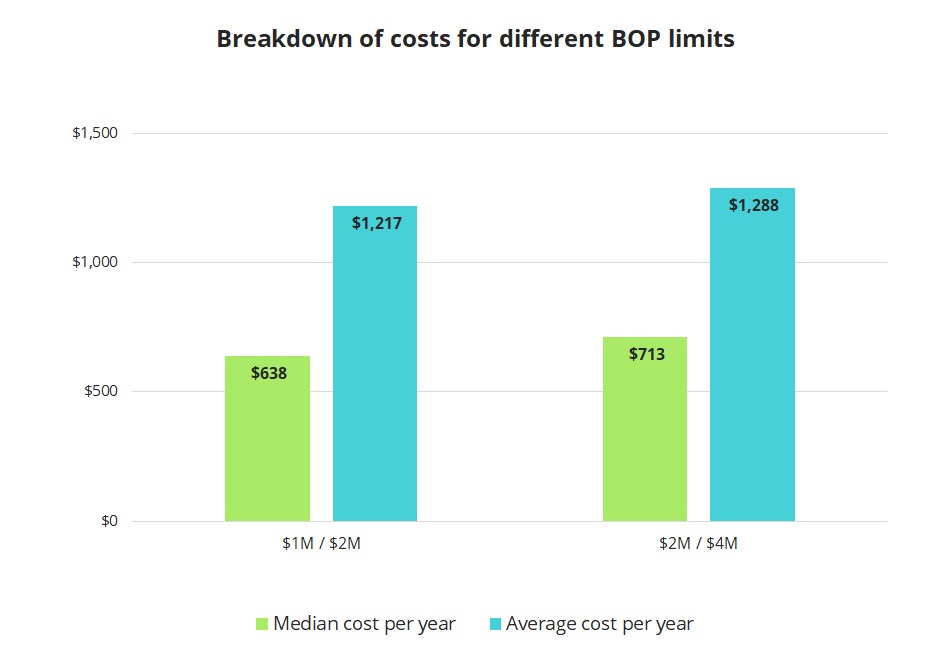

The Best Strategy To Use For BOP - Business Owners Policy Explained - FAQ - AmericanBOP cost In 2020, small companies nationwide who bought a new BOP policy through the Progressive Advantage Business Program paid approximately $84 monthly. While this gives you a basic idea of what BOP insurance coverage expenses, it's not necessarily what you'll pay. For example, the rate pointed out above is computed using several different organization types with varying levels of threat. You might find that the expense of your BOP insurance is greater if you have a history of claims, high coverage requirements, or high exposure to risk, for instance. Getting a custom-made quote is a terrific way to discover a rate that finest matches your distinct circumstance. Call us directly, or begin a quote online.  They'll assist you get a quote with the very best coverage for your particular business and spending plan. A Business Owners Policy from Progressive Commercial, or BOP insurance coverage for brief, combines liability and residential or commercial property coverages to create one policy that's ideal for lots of little services. The liability coverage available in a BOP is the same as a basic basic liability policy, consisting of home damage, item associated claims and client injury. The Single Strategy To Use For Business Owners Policy - Insurance Office of America It can secure you from things like fire damage, hail damage, theft and vandalism. It can likewise pay for certain claims involving loss of company earnings, inventory spoilage and more. BOP coverage is a fantastic alternative for small to medium-sized services with business home like dining establishments, retail stores and workplaces. Call us or begin a quote online today. DISCLAIMER: Progressive Casualty Ins. Co. & affiliates Typical questions Little to medium-sized organizations with business home ought to consider a BOP. It combines general liability and commercial property insurance coverage. This mix offers you both liability defense - for things like accidents and lawsuits - and business property insurance, which covers your structure and company personal effects. It's a protection consisted of in a company owner policy. A company owner policy covers liability claims, like customer injury and home damage not owned by the service, together with protecting your commercial building and its contents. Also Found Here combines general liability and property insurance coverage into one easy to handle policy.   How Business Owners Policy (BOP) - Bethany Insurance - Free Quote can Save You Time, Stress, and Money.There's no need for an additional basic liability insurance coverage policy if you have a BOP. Yes. Progressive can assist you get business insurance coverage, consisting of a company owner policy (BOP), in all states other than Hawaii. Browse by state. More information. |

||

|

||