|

|

|

|

|

|

| Topics >> by >> accounts_payable_city_of_k |

| accounts_payable_city_of_k Photos Topic maintained by (see all topics) |

||

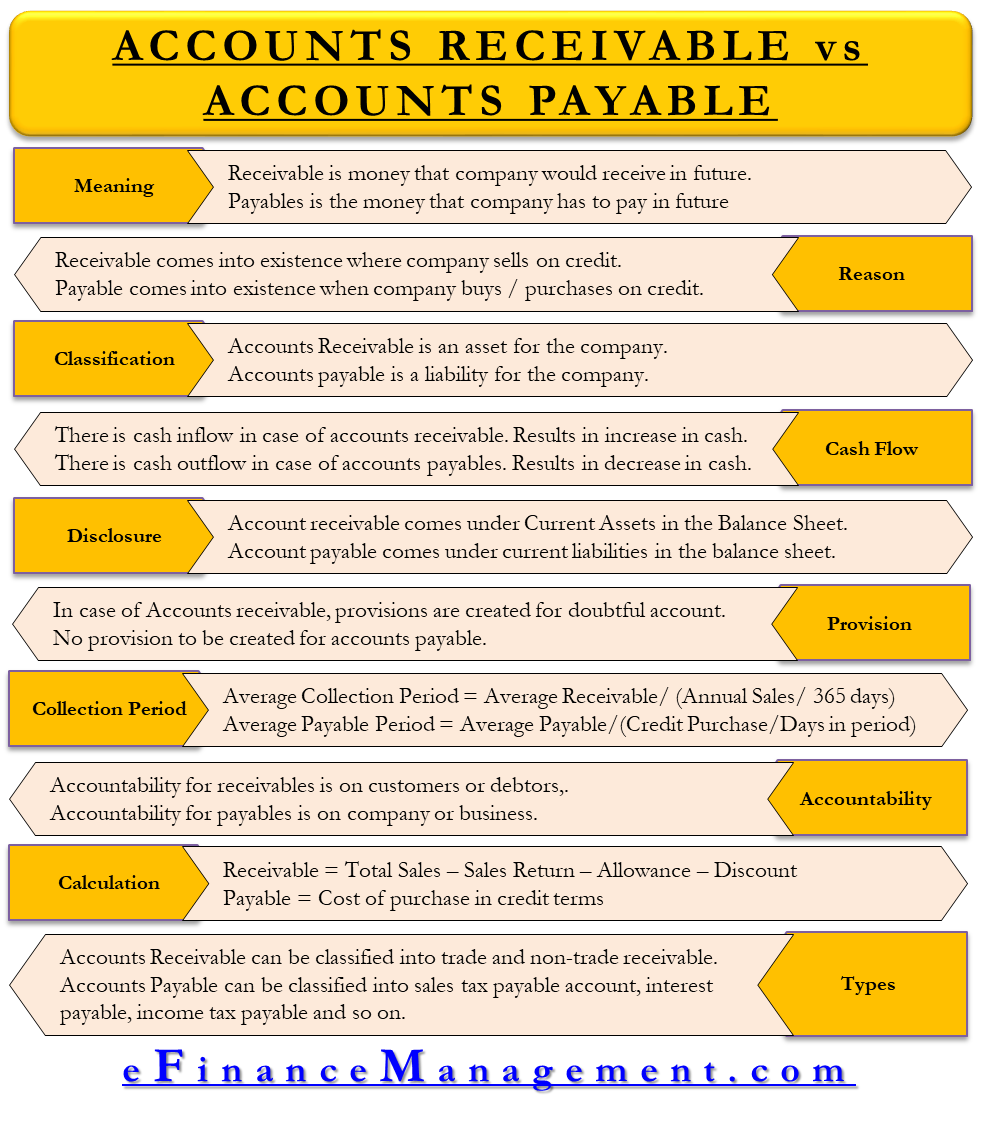

Not known Factual Statements About Accounts Payable Software - AP Automation - Kofax2016-04-13. Cite journal needs journal= (help).  What Are Accounts Payable (AP)? "Accounts payable" (AP) refers to an account within the general journal that represents a business's commitment to pay off a short-term financial obligation to its lenders or suppliers. Another common usage of "AP" describes the business department or division that is accountable for making payments owed by the company to suppliers and other creditors. The amount of all outstanding quantities owed to suppliers is revealed as the accounts payable balance on the business's balance sheet. The boost or reduce in total AP from the previous period appears on the money circulation declaration. Management may select to pay its exceptional costs as near to their due dates as possible in order to enhance money flow. Facts About Understanding Accounts Payable and Accounts Receivable UncoveredAccounts payable are financial obligations that need to be paid off within a given duration to avoid default. At the business level, AP describes short-term debt payments due to suppliers. Look At This Piece is essentially a short-term IOU from one business to another organization or entity. The other celebration would record the transaction as a boost to its receivables in the very same amount.  If AP increases over a prior period, that implies the business is buying more products or services on credit, instead of paying money. If a company's AP decreases, it indicates the business is paying on its previous period financial obligations at a much faster rate than it is buying brand-new items on credit. When using the indirect method to prepare the cash flow statement, the net boost or decrease in AP from the previous duration appears in the leading section, the capital from operating activities. Management can use AP to control the business's money flow to a particular degree. For example, if management wants to increase cash reserves for a particular duration, they can extend the time the company requires to pay all exceptional accounts in AP. |

||

|

||