|

|

|

|

|

|

| Topics >> by >> what_does_aetna_health_insu |

| what_does_aetna_health_insu Photos Topic maintained by (see all topics) |

||

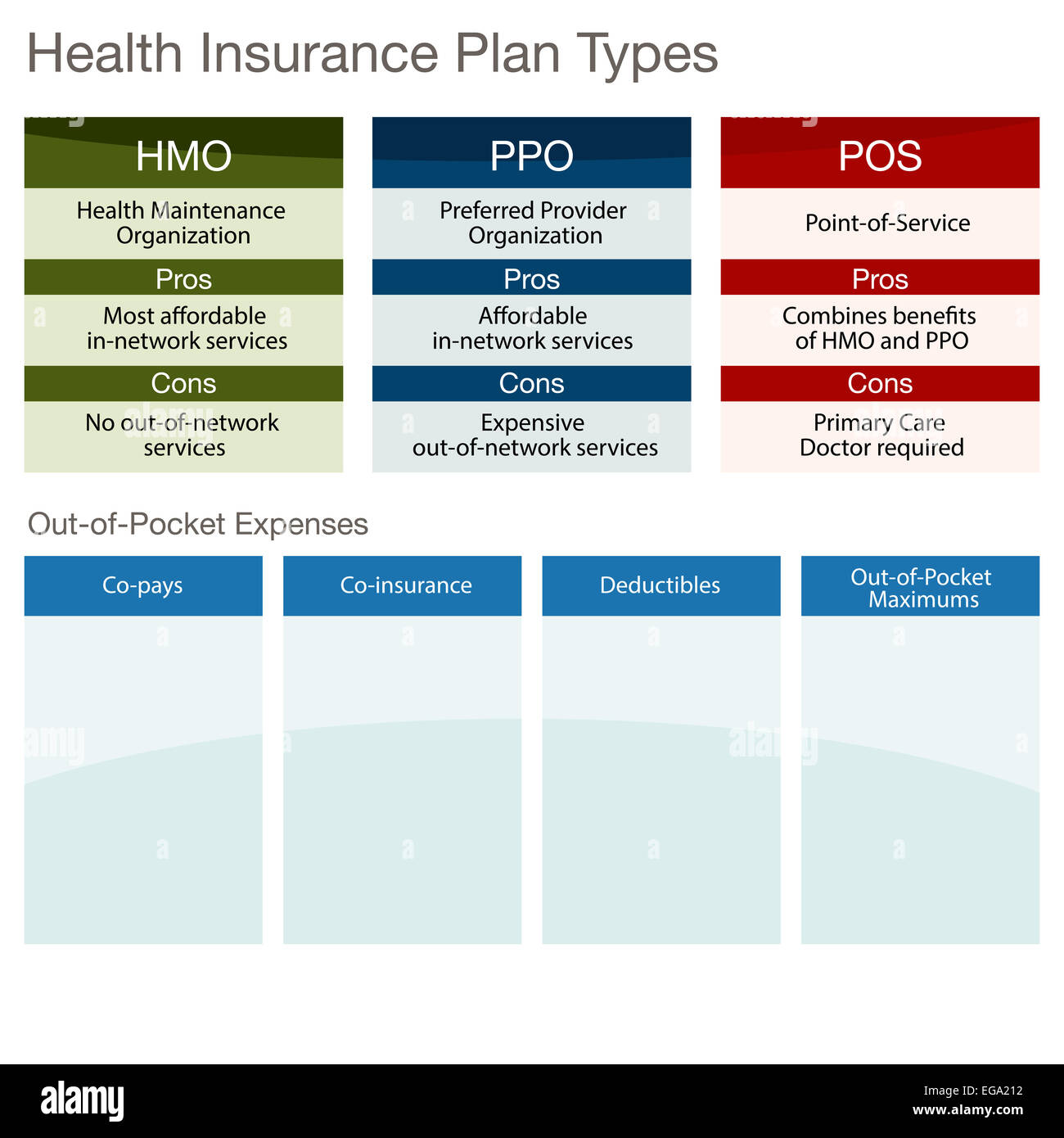

6 tips to help you get the most out of your health insurance plan Fundamentals ExplainedThese entities offer their services to managed care companies or directly to employers. - Approximately 10 million Medicare recipients purchase Medigap policies from personal insurance provider, at an expense that varies from approximately $1,000 to $5,000 annually, depending upon the choices available in the plan and the state of purchase.   This implies that Medigap actually pays the Medicare deductibles, copayments, and other costs that recipients are generally needed to pay as a way of spreading the cost burden and checking unnecessary use of services. [Medigap from Health Affairs, 9/11] Department of Management Solutions Medical Insurance Plans The State of Florida offers extensive health protection to meet the needs of you and your household through a range of health plans. Each plan is focused on assisting you remain healthy through preventive care advantages along with offering access to healthcare services when you require them. Some Ideas on Univera Healthcare: Health Insurance Plans You Need To KnowBelow are key highlights of the different kinds of strategies. Click each strategy name to read more. If you or your eligible reliant is Medicare eligible, make sure you understand what you need to do. Likewise, see different prescription drug costs on high deductible and standard plans. Read More Here might be a consider your selecting a health plan. How the Options Usually Work Your State Alternatives You might get care from any medical professional or healthcare company. Your expense for care is lower when you use PPO in-network providers. You have a deductible to fulfill before the strategy pays towards the cost of your health care services, except for many preventive care services.  Higher contributions (payroll reductions) for protection. Health care FSA. Copayments and coinsurance. Higher deductible (in network: $1,400 per person, $2,800 per family). You fulfill the deductible, and after that pay coinsurance for services you get. Lower month-to-month contributions (payroll deductions) for coverage. Health Savings Account (HSA) with contributions from the state plus Limited Purpose FSA for oral and vision. Connect for Health Colorado Things To Know Before You Get ThisFor more details on the high deductible plan, view this video. You pay the entire expense if you receive care from a non-network company, except in particular health emergencies. No deductible. You pay a copayment when you get care from network service providers Greater contributions for coverage. Health care FSA. Higher deductible (in network: $1,400 per individual, $2,800 per family). |

||

|

||