|

|

|

|

|

|

| Topics >> by >> little_known_questions_about |

| little_known_questions_about Photos Topic maintained by (see all topics) |

||

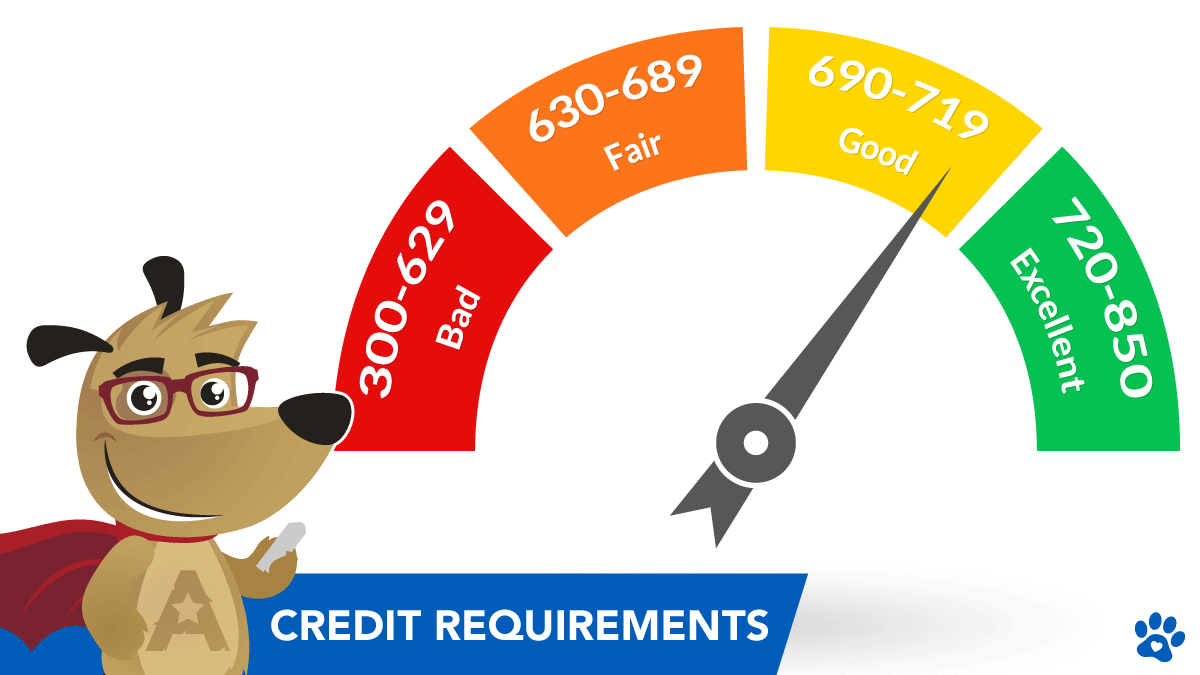

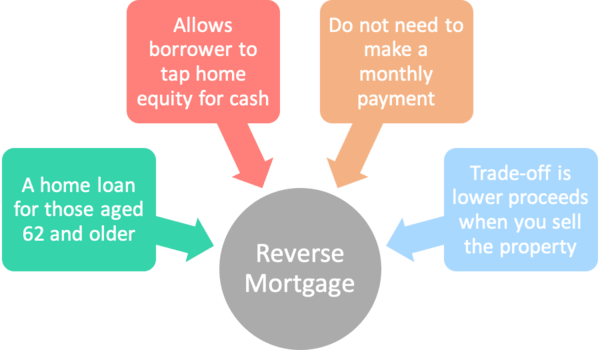

Some Of Las Vegas, NV - Finance of America MortgageWhat are reverse home loans? A reverse home mortgage, or Home Equity Conversion Home Loan (HECM), is a type of home mortgage available to property owners 62 or older who have substantial equity (normally a minimum of 50%) in their house. This financial tool can benefit people who require additional capital for other expenses, as the worth of their home's equity can be transformed to money, getting rid of monthly home mortgage payments.  This is called a "reverse" home loan, since in contrast to a conventional home loan, the lending institution makes the payments to the borrower. Reverse home mortgage quick view Available to homeowners 62 and older One-time FHA MI fee of 2% of the home's value Borrow as much as 80% of the home's worth Debtor must have adequate equity to certify Utilized for main house just No prepayment charge Your Custom Reverse Home Loan Quote Start your free quote from Mann Mortgage Just how much money can you obtain? The amount of money a borrower can get through a reverse mortgage is reliant on their age, the existing reverse mortgage/HECM rates of interest, their current mortgage balance if they have one, and what an independent appraiser figures out as their house's current worth. House equity is the difference in between what a house owner owes in a home loan compared to what their home deserves. If Official Info Here deserves $300,000 and they owe $150,000 on their mortgage, they would have $150,000 in home equity. Key duties of homeowners with a reverse mortgage Property owners with a reverse mortgage have 3 primary obligations: The borrower needs to in the house as a primary home The customer must preserve the house in great condition Taxes, insurance coverage and other own a home expense must be paid Pros of a reverse mortgage It may be a great alternative for homeowners with minimal earnings and a great deal of equity in their house.  Rumored Buzz on Five Star Mortgage, Reverse Mortgage Service Las Vegas NVThe reverse mortgage could also be used to pay off their preliminary home mortgage so they will no longer have to make month-to-month payments. Cons of a reverse home loan The primary balance will increase over time as the interest and FHA MI costs accrue. Know that if a borrower isn't utilizing the home as a primary house, it may result in the loan needing to be repaid earlier. |

||

|

||